ETFs, or Exchange-Traded Funds, have rapidly become one of the most popular investment products worldwide. They blend the diversification advantages of mutual funds with the ease of stock trading. From leading options such as the SPDR S&P 500 ETF in the U.S. to specialized thematic ETFs across Europe and Asia, they are now a go-to choice for both retail and institutional investors.

Pakistan’s capital markets introduced ETFs in 2020 with the launch of the first equity-based products. Since then, several funds have been listed, covering conventional equity, Islamic equity, momentum-based strategies, consumer indices, and even fixed income. Yet, despite solid returns, the domestic ETF market has not grown at the pace seen globally. This article explores how ETFs work, evaluates the current ETFs listed on the Pakistan Stock Exchange (PSX), analyzes their performance, and identifies the structural challenges that have prevented them from gaining mass adoption.

Confused between Stocks, Funds & ETFs? Discover which one is best for you!

What Are ETFs and How Do They Work?

An Exchange Traded Fund is a basket of securities—usually stocks or bonds—that aims to replicate the performance of a particular index. For example, an ETF tracking the KSE-100 index would hold shares in the same proportion as the index itself. Investors buy and sell ETF units on the stock exchange just like individual company shares.

The main appeal of ETFs lies in three features:

- Diversification: With a single purchase, investors gain exposure to a wide set of securities.

- Liquidity: Investors can trade ETFs at any time during market hours, while mutual funds are only priced and traded once daily after markets close.

- Cost-efficiency: They generally have lower expense ratios than actively managed mutual funds.

Global ETF Adoption – A Broader Perspective

Exchange-Traded Funds (ETFs) have transformed global investing, becoming one of the fastest-growing financial instruments. As of July 2025, worldwide ETF assets under management (AUM) reached a record USD 17.34 trillion, supported by USD 1.09 trillion in net inflows so far this year. This marks the 74th consecutive month of positive inflows, highlighting their increasing popularity across investor classes.

The scale of the industry is striking: around 14,600 ETF products are listed on 81 exchanges across 63 countries, managed by nearly 900 providers.

While passive, index-tracking ETFs dominate, active ETFs are gaining ground. Global active ETF AUM reached USD 1.24 trillion in 2024, with equity-focused strategies accounting for more than half. Importantly, although they represent less than 10% of total ETF AUM, active ETFs captured about 20% of global net inflows in 2023, showing strong demand for active management within the ETF wrapper.

Looking ahead, analysts project ETF assets could double to USD 30 trillion within five years, cementing their role as a core investment vehicle worldwide

ETFs on the Pakistan Stock Exchange

Pakistan introduced ETFs in 2020 with the launch of the UBL Pakistan Enterprise ETF (UBLPETF) and the NIT Pakistan Gateway ETF (NITGETF). Since then, more products have entered the market, offering variety to investors. Today, eight ETFs are listed on PSX:

- UBL Pakistan Enterprise ETF (UBLPETF)

- NIT Pakistan Gateway ETF (NITGETF)

- NBP Pakistan Growth ETF (NBPGETF)

- HBL Total Treasury ETF (HBLTETF)

- Alfalah Consumer Index ETF (ACIETF)

- JS Momentum Factor ETF (JSMFETF)

- Mahaana Islamic Index ETF (MIIETF)

- Meezan Pakistan ETF (MZNPETF)

These ETFs cover equity indices, Shariah-compliant baskets, thematic strategies like momentum, and fixed income. On paper, they offer investors low-cost access to broad and diversified portfolios.

Performance of ETFs in Pakistan

Pakistan’s Exchange Traded Funds (ETFs), despite limited retail and institutional participation, have delivered exceptional performance in recent years. The equity-focused ETFs in particular have captured the market’s momentum, often outpacing both actively managed mutual funds and the benchmark PSX index. The table below presents the NAVs alongside annual returns from 2021 to 2025 (YTD).

ETF Performance (NAV and Annual Returns)

| ETF | NAV (PKR) (29/08/25) | 2021 | 2022 | 2023 | 2024 | 2025 | YTD |

| HBLTETF | 104.93 | – | – | 14.0% | 20.0% | 16.0% | 10.2% |

| UBLPETF | 33.48 | 24.6% | -19.0% | 10.8% | 92.0% | 63.7% | 16.7% |

| MZNPETF | 17.55 | 15.6% | -23.4% | -1.3% | 85.8% | 31.76% | 5.0% |

| NBPGETF | 25.84 | – | -13.5% | 5.4% | 85.4% | 56.1% | 23.9% |

| NITGETF | 31.16 | 19.7% | -12.6% | 9.6% | 93.4% | 62.2% | 12.8% |

| JSMFETF | 11.09 | – | -6.8% | -11.0% | 132.3% | 68.4% | -0.6% |

| MIIETF | 15.08 | – | – | – | – | 66.47% | 13.2% |

The performance data highlights the contrasting return patterns across Pakistani ETFs over the past five years. The 2024 equity rally served as the main driver of extraordinary gains, lifting most funds sharply before performance normalized in 2025.

Among the standout performers, the UBL Pakistan Enterprise ETF (UBLPETF) delivered exceptional results, rebounding from a decline in 2022 to post a 92% surge in 2024, followed by another 64% in 2025, making it one of the strongest long-term gainers in the segment. Similarly, the NIT Gateway ETF (NITGETF) and NBP Growth ETF (NBPGETF) each produced annual returns above 85% in 2024, underlining the appeal of broad equity exposure during market upswings.

Factor-based strategies also proved highly effective. The JS Momentum Factor ETF (JSMFETF) delivered a spectacular 132% return in 2024, the highest across the group, though its earlier volatility—including double-digit losses in 2022 and 2023—highlights the high-risk/high-reward profile of momentum-driven products.

On the Islamic investing side, the Meezan Pakistan ETF (MZNPETF) maintained its reputation as a retail favorite, bouncing back strongly with an 86% gain in 2024 and delivering steady positive returns thereafter. Meanwhile, the Mahaana Islamic Index ETF (MIIETF), though relatively new, quickly made its mark with a 66% return in 2025, signaling strong investor interest in Shariah-compliant strategies.

By contrast, the HBL Total Treasury ETF (HBLTETF) stood out for its stability rather than explosive growth. With annual returns ranging between 14% and 20%, it continues to appeal to conservative investors focused on capital preservation and steady income, offering a fixed-income alternative within the ETF landscape.

KSE-100 vs. ETF Performance

The table below compares the year-on-year returns of the KSE-100 index with leading ETFs, highlighting how funds have either amplified or diverged from market performance.

Annual Returns: KSE-100 vs. ETFs (%)

| Fiscal Year | KSE-100 Index | UBLPETF | JSMFETF | NITGETF | NBPGETF | MZNPETF | MIIETF | HBLTETF |

| FY2021 | +37.6% | +24.6% | – | +19.7% | – | +15.6% | – | – |

| FY2022 | –12.1% | –19.0% | –6.8% | –12.6% | –13.5% | –23.4% | – | – |

| FY2023 | –0.4% | +10.8% | –11.0% | +9.6% | +5.4% | –1.3% | – | +14.0% |

| FY2024 | +81.7% | +92.0% | +132.3% | +93.4% | +85.4% | +85.8% | – | +20.0% |

| FY2025 | +66.7% | +63.7% | +68.4% | +62.2% | +56.1% | +31.8% | +66.47% | +16.0% |

| YTD | +27.01% | +16.7% | –0.6% | +12.8% | +23.9% | +5.0% | +13.2% | +10.21% |

From FY2021 to FY2025, Pakistan’s ETFs demonstrated mixed but often amplified movements relative to the KSE-100 index. In FY2021, the index advanced +37.6%, with ETFs trailing—UBLPETF gained +24.6%, NITGETF +19.7%, and MZNPETF +15.6%.

In FY2022, the benchmark dropped –12.1%, and ETFs largely mirrored the decline. Losses deepened for MZNPETF (–23.4%), UBLPETF (–19.0%), and NITGETF (–12.6%), while JSMFETF (–6.8%) held up relatively better.

By FY2023, with the index nearly flat (–0.4%), select ETFs outperformed—UBLPETF (+10.8%) and NITGETF (+9.6%) stood out, while HBLTETF (+14.0%) provided steady returns, underscoring its defensive profile.

The FY2024 bull run saw the KSE-100 surge +81.7%, but ETFs magnified the rally: JSMFETF (+132.3%), UBLPETF (+92.0%), and NITGETF (+93.4%) all outpaced the index, while MZNPETF (+85.8%) and NBPGETF (+85.4%) tracked closely.

In FY2025, gains moderated, with the KSE-100 up +66.7%. ETFs again followed suit: JSMFETF (+68.4%), UBLPETF (+63.7%), and NITGETF (+62.2%) remained aligned with the benchmark, while MZNPETF (+31.8%) underperformed. HBLTETF (+16.0%) continued its role as a low-volatility option.

Year-to-date (2025 YTD), the KSE-100 has returned +27.0%, while NBPGETF (+23.9%) leads ETF performance, with others posting mixed results.

This highlights the strongest performance of equity-based ETFs like UBL and JSMFETF during rallies, while more conservative options such as HBLTETF provided stability across market cycles.

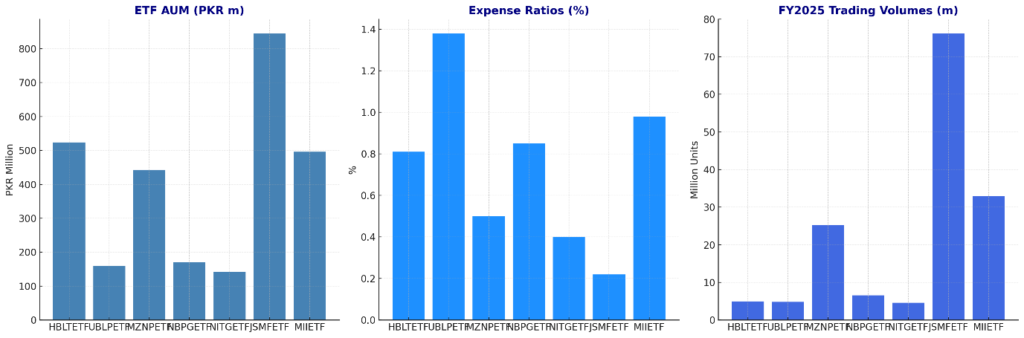

Assets, Liquidity, and Expenses

While performance has been stellar, the challenge for Pakistan’s ETF ecosystem lies in scale, liquidity, and cost efficiency. The market remains shallow compared to global benchmarks, with only a handful of funds achieving meaningful assets under management (AUM).

ETF Market Characteristics on (29/08/25)

| ETF | AUM (PKR) | Expense Ratio | FY2025 Trading Volume |

| HBLTETF | 524m | 0.81% | 5.0m |

| UBLPETF | 160m | 1.38% | 4.8m |

| MZNPETF | 443m | 0.50% | 25.2m |

| NBPGETF | 170m | 0.85% | 6.6m |

| NITGETF | 142m | 0.40% | 4.57m |

| JSMFETF | 845m | 0.22% | 76.2m |

| MIIETF | 496m | 0.98% | 32.9m |

The largest fund by AUM is JSMFETF, with PKR 845 million, reflecting investor confidence in factor-based strategies. It is followed by MIIETF (PKR 496m) and MZNPETF (PKR 443m), both Islamic ETFs, underscoring the dominant role of Shariah-compliant products in building scale. However, older funds like UBLPETF and NITGETF, despite strong performance, have struggled to attract assets, with AUM below PKR 200m.

Liquidity remains highly uneven. JSMFETF dominates trading with over 76 million units exchanged in FY2025, while MIIETF and MZNPETF also show healthy participation. In contrast, some ETFs such as UBLPETF and NITGETF remain illiquid, with trading volumes under 5 million units, limiting their appeal for institutions that require deep and efficient markets.

Expense ratios vary widely across the spectrum. JSMFETF’s fee of 0.22% is globally competitive, making it attractive by international standards. By contrast, UBLPETF charges 1.38%, which is considered high even relative to global emerging markets. Such discrepancies highlight the lack of uniform pricing standards in the domestic ETF space and may pose barriers to broader adoption.

Why ETFs Haven’t Picked Up Yet

Despite strong returns and attractive costs, Pakistan’s ETFs remain underdeveloped. Several challenges explain this:

- Low Awareness: Retail investors are unfamiliar with ETFs, often confusing them with mutual funds.

- Liquidity Constraints: Thin trading volumes discourage institutional players who require the ability to enter and exit positions efficiently.

- Distribution Gaps: ETFs are not marketed as aggressively as mutual funds, limiting visibility.

- Cost Mismatch: While cheaper than mutual funds, expense ratios in Pakistan are still higher than global averages.

- Regulatory Ecosystem: Absence of strong market-making incentives has prevented efficient arbitrage, keeping bid–ask spreads wide.

The Way Forward

For ETFs to succeed in Pakistan, several reforms and initiatives are needed:

- Investor Education: Brokers, asset managers, and regulators must conduct campaigns to explain how ETFs work and their advantages.

- Market Making: Encouraging dedicated market makers can ensure tighter spreads and better liquidity.

- Lower Costs: Reducing expense ratios closer to global standards will make ETFs more attractive to long-term investors.

- Product Innovation: Launch of sector-specific and commodity-backed ETFs could expand the investor base.

- Institutional Adoption: Pension funds, insurers, and large investors need to be encouraged to allocate to ETFs, providing scale and stability.

Conclusion

ETFs in Pakistan have shown impressive performance since their introduction, with several funds delivering triple-digit returns over three years. Yet, they remain niche products with limited scale and liquidity. Compared to the global ETF industry, Pakistan is still in the early stages of adoption.

The opportunity, however, is clear. With greater awareness, lower costs, improved liquidity, and stronger institutional participation, ETFs can play a transformative role in deepening Pakistan’s capital markets and providing retail investors with a simple, transparent, and cost-efficient way to invest.

One response

What’s Taking place i’m new to this, I stumbled upon this I have

discovered It positively helpful and it has helped me

out loads. I’m hoping to give a contribution & assist different users like its helped me.

Great job.