Introduction

When one speaks of the Pakistani banking sector, Habib Bank Limited (HBL) is often the first name that comes to mind. With roots that trace back to pre-independence years and a journey that mirrors the economic history of Pakistan itself, HBL stands as the largest commercial bank in the country by assets and deposits. Over decades, the bank has endured nationalization, privatization, regulatory challenges, and global scrutiny, yet has consistently managed to hold its ground as a financial giant.

For investors, HBL is not just another bank stock; it is a bellwether for the economy, a barometer of investor sentiment, and a long-term play on the banking sector’s growth. In this report, we review HBL’s financial performance over the last six years (2019–2024), analyze its profitability, asset quality, shareholder returns, and compare it with peers like UBL and MEBL. Importantly, we highlight the growing significance of HBL’s Islamic banking business, which serves as a key pillar for future growth and investor appeal.

Company Overview

Habib Bank Limited (HBL) is a diversified, universal bank that provides retail, corporate, SME, agriculture, treasury, investment banking, and Islamic banking services. It operates the country’s largest branch network, with over 1,700 domestic branches, and serves more than 37 million customers. Internationally, HBL maintains presence in 25 countries, cementing its role as Pakistan’s most globalized bank.

The bank is majority-owned by the Aga Khan Fund for Economic Development (AKFED), which took over management in 2004 after privatization. AKFED’s stewardship has brought stability, governance, and strategic direction.

A unique differentiator for HBL is its Islamic Banking division. HBL’s Islamic banking division, supported by a specialized Shariah Supervisory Board and a comprehensive range of Shariah-compliant financial solutions, has become one of the most rapidly expanding Islamic banking operations in Pakistan. For customers, this represents ethical financial solutions aligned with faith; for investors, it provides resilience, diversification, and an avenue of structural growth.

Recent Financial Performance

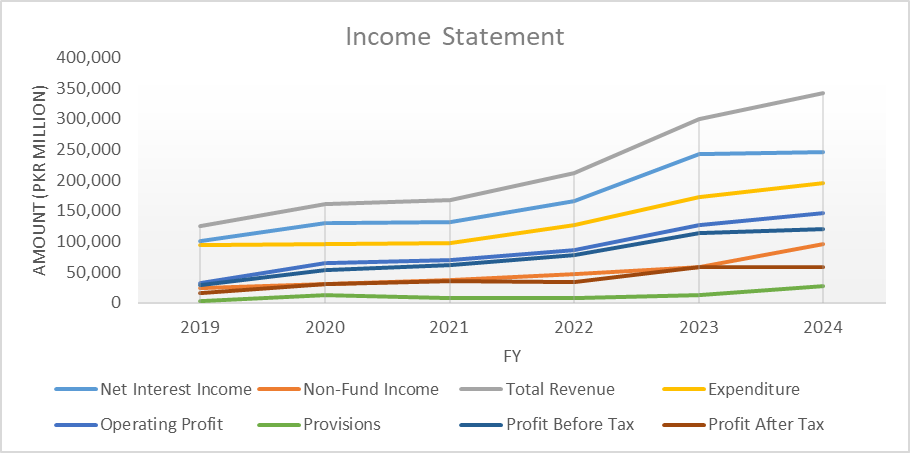

Income Statement (PKR million)

| Fiscal Year | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

| Net Interest Income | 101,323 | 130,104 | 131,419 | 165,563 | 242,133 | 245,622 |

| Non-Fund Income | 24,162 | 30,595 | 36,311 | 46,732 | 57,451 | 96,512 |

| Total Revenue | 125,485 | 160,699 | 167,730 | 212,294 | 299,584 | 342,134 |

| Expenditure | 93,290 | 95,449 | 97,615 | 126,783 | 172,767 | 195,196 |

| Operating Profit | 32,195 | 65,250 | 70,115 | 85,512 | 126,817 | 146,938 |

| Provisions | 3,314 | 12,220 | 8,087 | 8,482 | 13,266 | 26,604 |

| Profit Before Tax | 28,881 | 53,031 | 62,028 | 77,030 | 113,551 | 120,334 |

| Profit After Tax | 15,500 | 30,913 | 35,507 | 34,398 | 57,757 | 57,805 |

HBL’s revenue has shown strong growth over the past five years, rising from PKR 125 billion in 2019 to PKR 342 billion in 2024. This momentum was driven by robust core banking operations and expanding non-fund income, including fees and trading gains, which diversified earnings and reduced dependence on interest spreads. Despite elevated provisioning costs, profit after tax stabilized near PKR 58 billion in 2023–24, reflecting HBL’s resilience in challenging economic conditions.

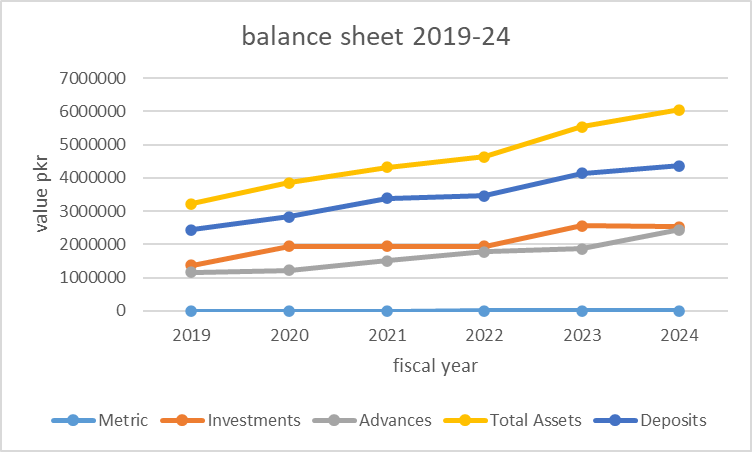

Balance Sheet (PKR million)

| Metric | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

| Investments | 1,379,607 | 1,948,577 | 1,948,956 | 1,948,801 | 2,562,299 | 2,528,200 |

| Advances | 1,166,957 | 1,223,510 | 1,507,047 | 1,782,498 | 1,861,345 | 2,435,435 |

| Total Assets | 3,227,132 | 3,849,063 | 4,317,468 | 4,638,806 | 5,534,348 | 6,055,113 |

| Deposits | 2,437,597 | 2,830,371 | 3,381,998 | 3,469,342 | 4,142,352 | 4,370,371 |

| Borrowings | 382,206 | 544,108 | 436,258 | 583,771 | 665,043 | 826,883 |

| Equity | 224,752 | 265,495 | 283,686 | 285,022 | 366,021 | 410,798 |

HBL’s balance sheet has demonstrated robust and consistent growth over the review period, with total assets surpassing PKR 6 trillion in 2024, reflecting its dominant market presence. A key driver of this expansion has been the accelerated growth in advances, which outpaced deposits, lifting the advances-to-deposits ratio to 55.7%. This shift signals a stronger focus on lending activity and margin enhancement. At the same time, the equity base recorded an impressive 83% increase between 2019 and 2024, supported by retained earnings and consistent profitability. Together, these developments underline HBL’s strengthening financial foundation and its ability to support long-term growth.

Valuation Metrics & Ratios

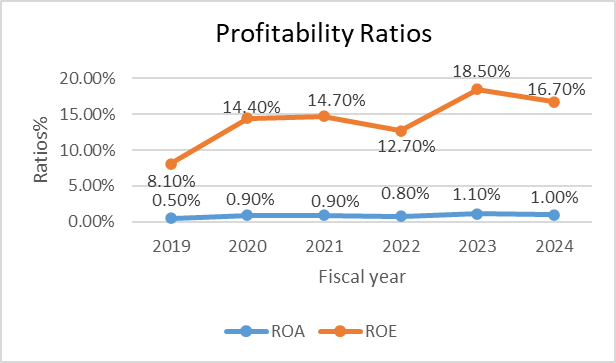

Profitability Ratios

| Metric | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

| ROA | 0.5% | 0.9% | 0.9% | 0.8% | 1.1% | 1.0% |

| ROE | 8.1% | 14.4% | 14.7% | 12.7% | 18.5% | 16.7% |

| EPS (PKR) | 10.5 | 21.1 | 23.9 | 23.2 | 39.3 | 39.9 |

HBL’s profitability ratios demonstrate notable progress in efficiency and returns over the past five years. ROA improved from 0.5% in 2019 to 1.1% in 2023, easing slightly to 1.0% in 2024, reflecting stronger earnings from its asset base. ROE surged to 18.5% in 2023 before moderating to 16.7% in 2024, supported by effective capital management. EPS also nearly doubled, rising from PKR 23.2 in 2022 to PKR 39.9 in 2024, reinforcing shareholder value creation.

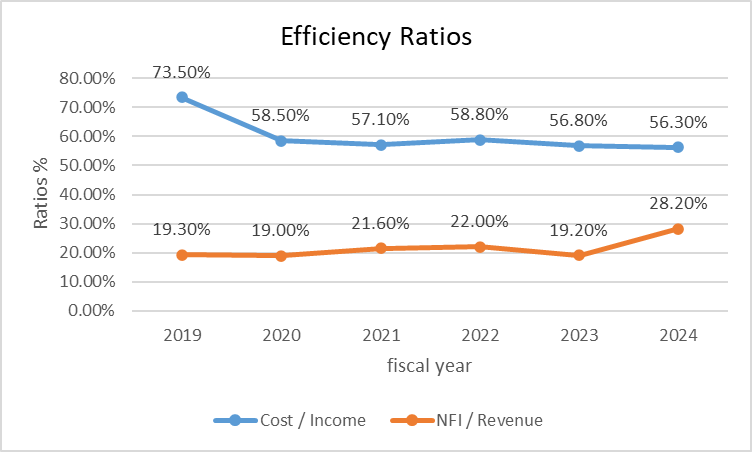

Efficiency Ratios

| Metric | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

| Cost / Income | 73.5% | 58.5% | 57.1% | 58.8% | 56.8% | 56.3% |

| NFI / Revenue | 19.3% | 19.0% | 21.6% | 22.0% | 19.2% | 28.2% |

HBL improved efficiency as the cost-to-income ratio fell from 73.5% in 2019 to 56% in 2024, aided by digitalization and tighter cost control. Non-fund income rose to 28% of revenue, reducing reliance on spreads. This diversification strengthens earnings resilience and supports sustainable profitability in volatile market conditions.

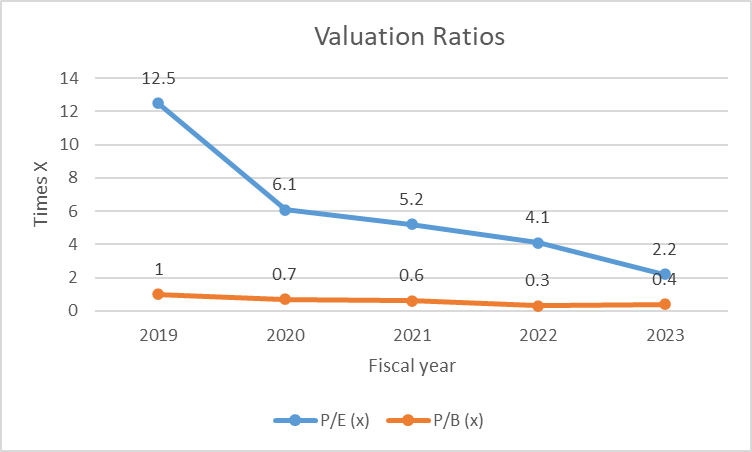

Valuation Ratios

| Metric | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

| P/E (x) | 12.5 | 6.1 | 5.2 | 4.1 | 2.2 | 3.2 |

| P/B (x) | 1.0 | 0.7 | 0.6 | 0.3 | 0.4 | 0.6 |

HBL trades at deep discounts, with a P/E of 3.2× in 2024 versus UBL’s ~6× and MEBL’s ~8×. Its P/B of 0.6× also lags peers, reflecting undervaluation. Despite strong earnings, balance sheet strength, and rising dividends, the market underprices HBL, creating an attractive long-term value and income opportunity.

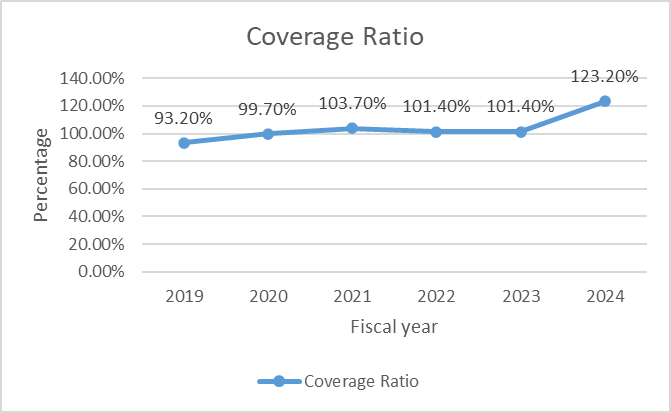

Asset Quality & Liquidity

| Metric | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

| Coverage Ratio | 93.2% | 99.7% | 103.7% | 101.4% | 101.4% | 123.2% |

The coverage ratio surged to 123%, providing ample buffers against future loan losses and reinforcing the bank’s resilience in a challenging operating environment.

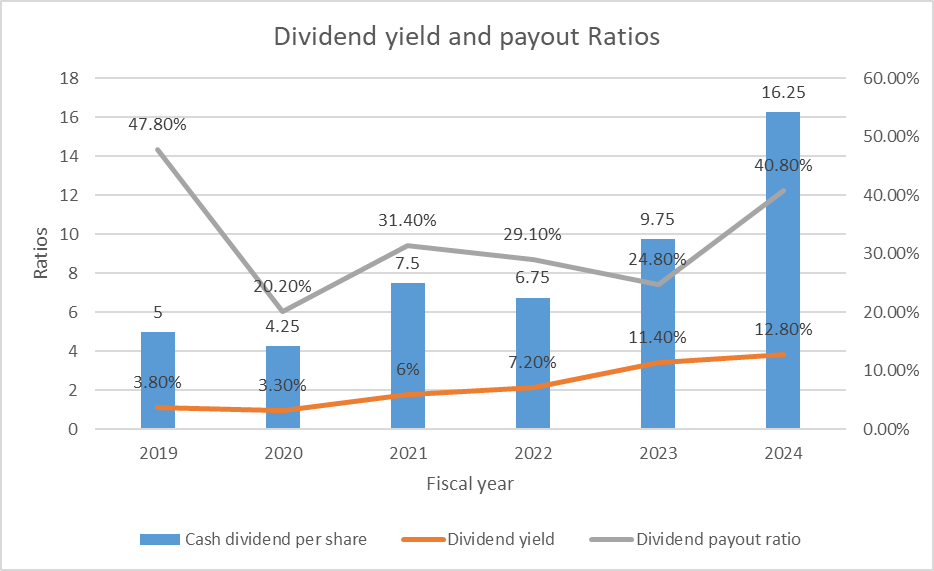

Dividend & Payout History

Dividend Yield and Payout Ratio:

| Year | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

| Cash dividend per share | 5.0 | 4.25 | 7.5 | 6.75 | 9.75 | 16.25 |

| Dividend yield | 3.80% | 3.30% | 6% | 7.20% | 11.40% | 12.80% |

| Dividend payout ratio | 47.80% | 20.20% | 31.40% | 29.10% | 24.80% | 40.80% |

HBL has demonstrated a strong commitment to shareholder returns, increasing its cash dividend per share substantially from PKR 5.0 in 2019 to PKR 16.25 in 2024. This growth reflects strong profit generation and a committed capital return policy.

The dividend yield has expanded significantly from 3.8% to an attractive 12.8% in 2024, making HBL a high-yield stock in the sector.

The payout ratio was conservative from 2020-2023 (20-31%), prioritizing capital retention. The jump to 40.8% in 2024 indicates management’s confidence in sustained earnings and a shift towards higher shareholder returns.

Risk Measures

| Avg. annual return(5 years ) | 23% |

| standard deviation | 1.224 |

| Sharpe ratio | 0.099 |

| Beta | 1.06 |

HBL’s risk profile reflects moderate volatility with a standard deviation of 1.224, indicating fluctuations in returns. The stock carries a beta of 1.1, suggesting it is slightly more volatile than the overall market and tends to amplify market movements. Despite delivering an impressive 23% average annual return over five years, the Sharpe ratio of 0.099 highlights weak risk-adjusted performance, implying returns are not proportionate to the level of risk undertaken by investors.

Industry & Market Position of HBL

1. Market Share & Competition

HBL retains its status as Pakistan’s leading commercial bank, holding a dominant market position with the largest share of deposits and advances in the industry. According to its 2024 Annual Report, HBL’s deposit market share stood at 12.1% while its advances market share reached 12.9% in 2024. The bank achieved a significant milestone of crossing PKR 5.2 trillion in deposits by June 2025, building upon its PKR 4.37 trillion deposit base reported in 2024. This growth has been fueled by a strategic focus on current accounts, which constitute 40.5% of domestic deposits, significantly reducing funding costs and enhancing profitability.

2. Islamic Banking Growth & Sector Outlook

HBL’s Islamic banking division represents a critical growth vector in Pakistan’s expanding Islamic finance sector. While Islamic banking currently holds approximately 25% of total industry deposits (up from 17-19% in 2020), HBL is strategically positioned to capture this growth through its dedicated Shariah-compliant products and services. The sector is projected to grow at ~12% annually through 2025, though adoption has lagged behind the State Bank of Pakistan’s target of 50% Islamic deposits by 2025, reaching only 24.9% penetration by December 2024.

3. Regulatory Environment

The operating landscape is defined by the Federal Sharia Court’s 2022 directive to transition to an interest-free economy by 2027. In response, the SBP has enacted measures like Circular IFPD-3 (2024), requiring conventional banks to submit formal plans for this shift. HBL’s established and growing Islamic banking window provides a strong foundation to navigate this regulatory transition effectively and capitalize on the changing market dynamics.

4. Competitive Positioning

While HBL enjoys market leadership, it faces robust competition from specialized Islamic banks. The bank leverages its unrivalled branch network (1,700+) and brand strength to compete. Its operational efficiency is reflected in a steadily improving cost-to-income ratio, which fell to 56.3% in 2024 from 73.5% in 2019, demonstrating disciplined cost management and effective digitalization initiatives despite a competitive environment.

Management & Governance of HBL

1. Ownership Structure & Stability

HBL’s ownership structure remains stable, with the Aga Khan Fund for Economic Development (AKFED) maintaining a controlling 51% stake, providing strategic consistency and minimizing operational volatility. Institutional investors hold approximately 12%, while the public float is 28.9%. Insider ownership remains minimal (<0.05%), indicating low internal trading risk and alignment with shareholder interests .

2. Leadership Expertise

Under the leadership of Chairman Sultan Ali Allana and CEO Muhammad Nassir Salim, HBL maintains experienced governance. Key executives like CFO Rayomond H. Kotwal (since 2014) provide stability, while specialized officers oversee compliance, technology, and Shariah governance. The management emphasizes digital transformation and risk management, supported by a board with deep institutional expertise.

3. Board Composition & Committees

HBL’s board includes independent directors and industry experts, ensuring robust oversight. Key committees include:

- Audit Committee: Chaired by Khaleel Ahmed, ensuring financial integrity.

- HR and Compensation Committees: Led by Najeeb Samie and Saba Kamal, aligning incentives with performance.

- Shariah Board: Scholars like Mufti Muhammad Zubair Usmani oversee Islamic banking compliance.

4. Transparency & Compliance

HBL maintains high transparency through PSX disclosures and audits by KPMG Taseer Hadi & Co.. The bank adheres to SBP regulations, with a dedicated compliance officer (Armughan Ahmed Kausar) ensuring robust frameworks. Historical regulatory challenges (e.g., a 2018 penalty) have been addressed through strengthened governance

News, Events & Announcements for HBL

1. Market Milestones & PSX Disclosures

HBL maintains active communication with investors through regular PSX disclosures, including financial results, dividend announcements, and board meeting outcomes. A significant recent disclosure highlighted the bank’s achievement of crossing PKR 5.2 trillion in deposits in the first half of 2025, reinforcing its position as Pakistan’s largest bank by deposits. The bank also frequently updates its Investor Relations portal with strategic and operational developments.

2. Strategic Expansion & Partnerships

HBL has pursued strategic growth initiatives, including:

- UAE Expansion: In 2024, HBL received regulatory approval to expand its operations in the UAE, targeting the corporate and retail banking segments to serve the Pakistani diaspora and international clients.

- Digital Transformation: The bank launched HBL Mobile App 3.0 and partnered with fintech players to enhance digital banking services, focusing on user experience and financial inclusion.

- Power Sector Financing: HBL participated in syndicated financing facilities for Pakistan’s energy sector, supporting infrastructure development and economic stability.

3. Regulatory Compliance & Historical Penalties

HBL has faced regulatory scrutiny in the past, notably a 2018 fine of $225 million by the New York State Department of Financial Services for anti-money laundering (AML) compliance failures. Since then, the bank has strengthened its AML and compliance frameworks, with no major penalties in recent years. It continues to work closely with SBP and international regulators to maintain robust governance.

4. Political & Macroeconomic Risks

As a systemically important bank, HBL is exposed to Pakistan’s macroeconomic and political dynamics. However, the bank has maintained operational independence, with no recent reports of direct political interference. It aligns with national economic policies, such as supporting SMEs and agriculture, while navigating challenges like inflation, currency volatility, and regulatory changes.

Conclusion: HBL – A Resilient Giant with Untapped Value

Habib Bank Limited remains Pakistan’s banking powerhouse, blending scale, resilience, and growth potential. Over the past five years, it has more than doubled revenues, fortified its balance sheet, and delivered steady profitability, with ROE peaking at one of the highest levels in the sector. Strong non-fund income, disciplined cost control, and robust provisioning have allowed the bank to weather macroeconomic turbulence while continuing to create value for shareholders. At the same time, HBL’s fast-growing Islamic banking division and ambitious digital transformation strategy position it at the forefront of future structural growth. Despite this solid performance, the stock still trades at a discount to peers, offering investors a rare opportunity to capture both attractive dividend yields and long-term capital appreciation. For those seeking exposure to Pakistan’s financial sector, HBL represents not just a safe bet—but a strategically rewarding one.

No responses yet