In Pakistan’s banking sector, two giants dominate the landscape. UBL vs MEBL. Meezan Bank (MEBL), the pioneer of Islamic banking, and United Bank Limited (UBL), a conventional powerhouse with deep digital roots. One thrives on Shariah-compliant, asset-backed finance, the other on interest-based lending and diversified revenue streams. For investors, the real question isn’t just about faith versus finance, it’s about which model delivers stronger returns, lower risk, and more sustainable growth.

Business Models: How They Make Money

While Meezan and UBL may seem like two sides of the same coin, the way they generate profits is strikingly different.

Meezan Bank (MEBL):

Revenue comes primarily from trade-based financing, leasing (ijarah), and sukuk investments, where returns are tied to real assets rather than fixed interest. This structure shields Meezan from excessive credit risk, reflected in its ultra-low NPL ratio under 2%. With deposits doubling in just five years, its balance sheet shows how strongly the Islamic model resonates with the market.

United Bank Limited (UBL):

UBL’s business model leans on net interest margins from lending, treasury securities, and a growing base of fee income. Unlike Meezan, UBL doesn’t rely on regulation-driven growth—it thrives on scale. Its global presence and digital platforms like UBL Omni generate multiple revenue streams, making it one of the most diversified financial institutions in Pakistan

Meezan’s model is asset-backed and regulation-fueled, while UBL’s is interest-driven and scale-oriented. Both models have strengths, but they respond differently to economic cycles and regulatory change.

Strategy: Where Are They Headed?

Meezan’s playbook is to cement itself as the default Islamic bank in a country moving towards a fully Shariah-compliant system by 2027. It’s not just expanding branches but also investing in fintech partnerships and mega-project financing (e.g., co-financing the PKR 1.2 trillion power sector restructuring)

UBL, meanwhile, is betting on digital dominance. With 28% annual growth in mobile app users and millions of rural clients through Omni, its strategy is clear: expand reach, reduce cost-to-income, and build loyalty through convenience

Risk & Asset Quality: The Tale of Two Loan Books

One of the clearest ways to measure banking risk is the Non-Performing Loan (NPL) ratio—the percentage of loans that borrowers have stopped repaying. It’s a window into credit discipline, customer quality, and resilience under stress. And here, the difference between Meezan and UBL is striking.

| NPL Ratios – Meezan Bank vs. UBL (2019–2024) | ||

| Year | Meezan Bank (MEBL) | United Bank Limited (UBL) |

| 2019 | 1.78% | 11.00% |

| 2020 | 2.81% | 13.70% |

| 2021 | 1.86% | 11.80% |

| 2022 | 1.34% | 9.20% |

| 2023 | 1.71% | 14.70% |

| 2024 | 1.62% | 7.40% |

Meezan’s non-performing loans have stayed impressively low, never above 3% in six years. This reflects the asset-backed, Shariah-compliant model, where financing is tied to tangible assets and risks are carefully managed. Even through economic turbulence, Meezan’s credit quality remains a standout strength.

UBL, meanwhile, shows the more volatile profile of conventional lending. Its NPL ratio has bounced between 7% and nearly 15%, highlighting exposure to stressed corporate sectors and unsecured loans. To its credit, UBL actively provisions against these risks, keeping its net infection ratio low, but the swings in gross NPLs show that its loan book is far more exposed to macroeconomic shocks.

Investor’s Takeaway:

If you want stability and lower credit risk, Meezan is the clear winner. Its disciplined, Shariah-based financing offers investors peace of mind. But if you’re comfortable with higher volatility in exchange for scale, diversification, and stronger dividends, UBL remains attractive—just know you’re buying into a higher-risk loan book.

Market Risk Metrics: Volatility, Returns & Sensitivity

To fully understand a bank’s risk profile, it’s not enough to look at loan book quality (NPLs) alone. Investors also need to consider how the stock behaves in the market — its volatility, sensitivity to the index, and whether returns are worth the risks. Here’s how Meezan Bank (MEBL) and United Bank Limited (UBL) stack up over the past five years:

| Metric (5-year) | Meezan Bank (MEBL) | United Bank Limited (UBL) |

| Avg Annual Return | 43% | 51% |

| Standard Deviation | 0.39 | 0.74 |

| Sharpe Ratio (Rf=11%) | 0.81 | 0.54 |

| Beta (vs KSE-100) | 0.82 | 1.2 |

MEBL

Meezan Bank (MEBL) has delivered impressive results in recent years, offering investors a blend of growth and stability. With an average annual return of 43% and relatively low volatility (σ = 0.39), the stock stands out against many sector peers. A Sharpe ratio of 0.81 shows that investors receive solid compensation for the risks taken, while a beta of 0.82 reflects lower sensitivity to overall market fluctuations. This mix of steady returns, contained volatility, and favorable risk-adjusted performance positions MEBL as an attractive choice for investors seeking growth with balanced risk exposure.

UBL

United Bank Limited (UBL) presents a different profile. It has generated higher average returns of 51%, which is impressive in raw performance terms, but these gains have come with significantly greater volatility (σ = 0.74). Its Sharpe ratio of 0.54 shows that while investors are compensated for the risk, the trade-off is less efficient compared to MEBL. In addition, a beta of 1.20 reflects greater sensitivity to market movements, which can amplify both gains and losses during periods of volatility. UBL, therefore, leans toward a higher-risk, higher-reward play, supported by its dividend track record and diversified earnings base.

Investor Takeaway: MEBL is best suited for risk-averse investors looking for a growth stock with defensive qualities. UBL, on the other hand, appeals to those who can tolerate volatility and prefer stronger absolute returns supported by dividends.

Financial Performance & Shareholder Returns: Growth vs. Dividends

The financial track records of Meezan Bank (MEBL) and United Bank Limited (UBL) highlight two very different approaches to creating value for investors. Meezan represents the growth-driven Islamic banking model, reinvesting heavily while still rewarding shareholders, whereas UBL reflects the conventional banking focus on high dividends, even at the expense of reinvestment. Comparing their earnings, returns, valuations, and payout policies reveals this contrast clearly.

Earnings per Share (EPS)

Meezan’s EPS has surged from PKR 12 in 2020 to PKR 57 in 2024, reflecting aggressive growth in Islamic banking operations and balance sheet expansion. UBL has also shown steady earnings growth, rising from PKR 17 to PKR 66 in the same period, though at a slower pace. While UBL’s scale provides stability, Meezan’s trajectory demonstrates a sharper growth curve.

| EPS Comparison (PKR) | ||

| Year | MEBL | UBL |

| 2025(TTM) | 53.28 | 81.91 |

| 2024 | 56.62 | 65.78 |

| 2023 | 47.18 | 43.44 |

| 2022 | 25.15 | 26.19 |

| 2021 | 15.84 | 25.23 |

| 2020 | 12.39 | 17.07 |

Return on Equity (ROE)

Meezan consistently posts industry-leading ROEs, ranging between 35% and 56% over the past five years, highlighting its ability to generate strong returns on shareholder funds. UBL has improved from 14% in 2020 to nearly 36% in 2024, but still trails Meezan’s superior efficiency. The contrast underscores Meezan’s growth-oriented profitability versus UBL’s steadier returns.

Price-to-Earnings (P/E Ratio)

Meezan trades at a relatively low P/E multiple, typically between 3–6×, suggesting that the market undervalues its earnings power despite robust growth. UBL’s P/E ratios of 4–7× reflect a more conservative valuation tied to its dividend track record. This makes Meezan more attractive for long-term re-rating potential, while UBL’s valuation mirrors its stable profile.

| Price-to-Earnings (P/E Ratio) | ||

| Year | MEBL | UBL |

| 2025(TTM) | 7.68 | 4.67 |

| 2024 | 4.27 | 5.81 |

| 2023 | 3.42 | 4.09 |

| 2022 | 3.96 | 3.85 |

| 2021 | 8.46 | 5.41 |

| 2020 | 6.7 | 7.37 |

Dividend Payout Ratio

Meezan typically distributes 24–52% of its profits, retaining the rest to finance expansion. In contrast, UBL pays out 70–100% of earnings, even exceeding profits in some years. This illustrates two opposing strategies: Meezan prioritizes reinvestment for growth, while UBL emphasizes maximizing shareholder distributions.

| Dividend Payout Ratio (%) | ||

| Year | MEBL | UBL |

| 2025(TTM) | 52.55 | 50.05 |

| 2024 | 49 | 66.9 |

| 2023 | 52 | 101.3 |

| 2022 | 24 | 84 |

| 2021 | 39 | 71.4 |

| 2020 | 44.05 | 70.3 |

Investor’s Takeaway:

Meezan offers a growth-first story, combining high profitability with reinvestment, while UBL positions itself as a dividend anchor, providing steady income. The contrast gives investors a clear choice between growth compounding (MEBL) and immediate cash returns (UBL).

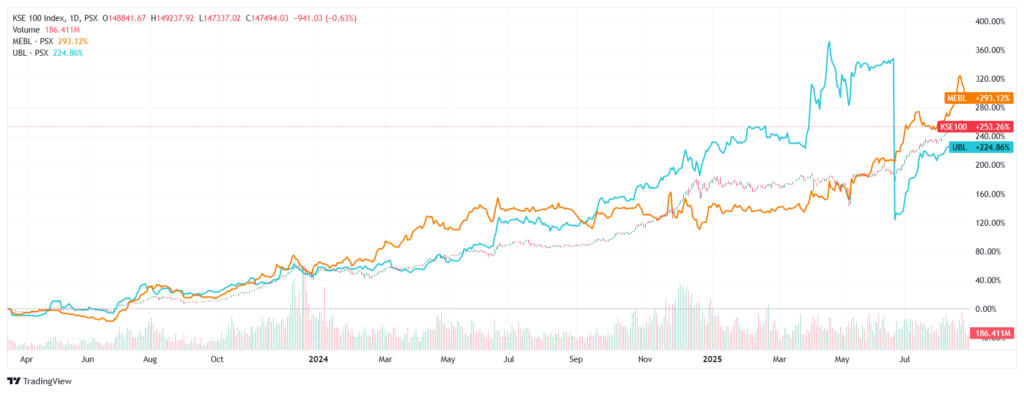

Stock Performance: MEBL vs. UBL (2020–2024)

Stock prices tell their own story, often louder than financial statements. Over the last five years, Meezan Bank (MEBL) and United Bank Limited (UBL) have taken very different paths to rewarding investors. While UBL leaned on jaw-dropping dividends, Meezan’s story has been one of sustained growth and compounding returns. Let’s break down how they stack up when we look at both price performance and total returns.

United Bank Limited (UBL):

| United Bank Limited (UBL) | ||||

| Year | Price (Rs.) | Dividend (Rs.) | Price Return (%) | Dividend Yield (%) |

| 2020 | 125.86 | 12 | – | 9.53% |

| 2021 | 136.58 | 18 | 8.50% | 13.18% |

| 2022 | 100.75 | 22 | -26.30% | 21.84% |

| 2023 | 177.84 | 44 | 76.50% | 24.47% |

| 2024 | 382.23 | 44 | 114.90% | 11.51% |

| 2025(TTM) | 275.95 | 41 | -27.81% | 14.86% |

UBL looks almost like a dividend engine in motion. Even in 2022, when the stock price fell 26%, dividends cushioned the blow with a 21% yield. The real fireworks came in 2023 and 2024, when triple-digit price growth combined with double-digit dividend yields delivered spectacular total returns. For income-seekers, UBL has been a dream pick.

Meezan Bank Limited (MEBL):

| Meezan Bank Limited (MEBL) | ||||

| Year | Price (Rs.) | Dividend (Rs.) | Price Return (%) | Dividend Yield (%) |

| 2020 | 104.44 | 6 | – | 5.74% |

| 2021 | 134.11 | 6 | 28.50% | 4.47% |

| 2022 | 99.54 | 8.5 | -25.80% | 8.54% |

| 2023 | 161.36 | 20 | 62.10% | 12.39% |

| 2024 | 241.97 | 28 | 49.90% | 11.57% |

| 2025(TTM) | 332.05 | 28 | 37.22% | 8.43% |

Meezan’s path has been about steady growth with reinvestment discipline. Except for a dip in 2022, the bank has rewarded investors with consistent double-digit returns and healthy dividends. 2023 and 2024 were especially strong, showing how the Islamic banking growth story translates into tangible gains for shareholders.

Performance Snapshot

Innovation & Product Strategies:

Meezan Bank: Shariah-Driven Innovation

Meezan’s biggest strength is its ability to translate conventional products into Shariah-compliant versions. From Islamic credit cards to auto and home financing via Ijarah, it has built an inclusive suite that rivals conventional banks. This ensures customers never feel restricted by choosing Islamic banking.

Meezan Bank: Digital Leap Forward

Beyond Shariah products, Meezan has invested heavily in digital transformation. Its mobile app, instant account opening features, and digital wallets make it competitive with conventional peers. This shows Meezan is not only defending its Islamic niche but also broadening its reach through technology.

UBL: Digital Banking Pioneer

UBL has branded itself as a digital-first bank. Its UBL Digital App is one of the most widely used in Pakistan, offering fund transfers, investments, bill payments, and even loan facilities through a seamless interface. By leveraging e-commerce gateways and fintech partnerships, UBL is shaping the digital customer experience.

UBL: Product Breadth and Scale

Where Meezan focuses on Shariah, UBL thrives on scale and diversity. Its product portfolio spans consumer loans, trade finance, wealth management, and corporate banking, giving it a dominant presence across these segments. This makes UBL particularly attractive for businesses and high-net-worth clients.

Conclusion: Two Banks, Two Investment Journeys

Meezan Bank and UBL may operate in the same financial landscape, but they represent two very different investment stories. Meezan, with its Shariah-driven model and steady digital expansion, appeals to long-term investors looking for compounding growth. Its strong ROEs and the rising demand for Islamic banking make it a reliable wealth builder. UBL, on the other hand, shines as a dividend powerhouse, rewarding shareholders with generous cash payouts while also positioning itself as a leader in digital banking. For income-focused investors, it offers immediate, high-yield returns that are hard to ignore. Ultimately, the choice comes down to strategy: Meezan builds your wealth for tomorrow, while UBL pays you handsomely today together, they reflect the dual faces of Pakistan’s evolving banking sector.

Read the fundamental stock analysis for Atlas Honda (ATLH)

No responses yet