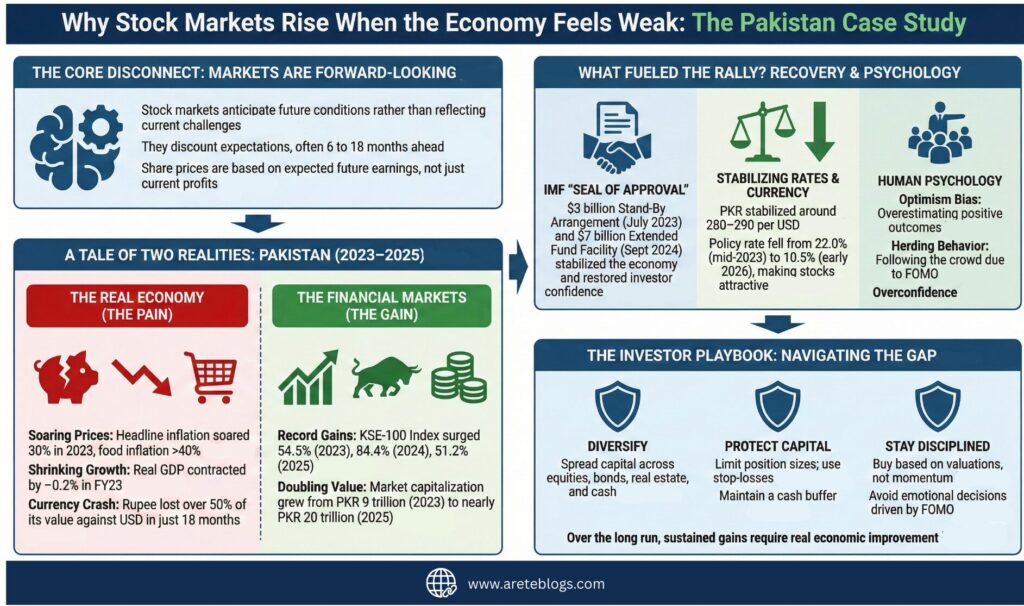

Many people are confused when stock markets rise during economic downturns. Households suffer from inflation, yet share prices rise significantly. Pakistan serves as a vivid example of this disconnect. In 2023, Pakistan faced significant economic difficulties. Basic needs became more expensive for average individuals as headline inflation exceeded 30% and food inflation exceeded 40% over several months. GDP contracted by −0.2% in fiscal year 2023, indicating a sharp slowdown in economic activity.

Large-scale industry saw a double-digit drop, and industrial output fell dramatically, indicating a slowdown in the economy and decreased production. The KSE-100 index crossed 60,000 points in late 2023 as the stock market surged even with these challenges. This contrast raises an important point: why do markets rise when daily financial conditions remain challenging?

Stock Markets Are Forward-Looking

Stock markets often rise even when economies are struggling because they anticipate future conditions rather than reflecting current challenges. Rather than reflecting the present state of the economy, they discount future expectations, often 6 to 18 months ahead. This anticipatory behavior is rooted in the way investors value companies: share prices are based on expected future earnings, not just current profits or economic conditions.

In Pakistan’s case, this forward-looking mechanism became especially pronounced during the 2023–2025 period. As the economy struggled with high inflation, currency depreciation, and political instability, the KSE-100 index began to rally. Investors were not ignoring the pain on the ground; rather, they were betting that the worst was over and that stabilization measures, especially the IMF’s Stand-By Arrangement, would pave the way for recovery.

This phenomenon is not unique to Pakistan. Globally, markets often rebound before economic data turns positive. For example, during the COVID-19 pandemic, global stock indices began to recover months before GDP growth resumed, as investors anticipated massive fiscal and monetary support. Similarly, in the aftermath of the 2008 financial crisis, equity markets bottomed out and started rising well before unemployment rates peaked.

Pakistan’s 2023 Macroeconomic Snapshot: A Tale of Two Realities

To understand the disconnect between the stock market and the real economy, it is essential to examine Pakistan’s macroeconomic landscape during 2023–2025.

Inflation, GDP, and Industrial Output

In 2023, Pakistan’s headline inflation soared above 30%, with food inflation exceeding 40% for several months. The rupee depreciated sharply, losing over 50% of its value against the US dollar in just 18 months. Foreign exchange reserves dwindled to precarious levels, at times covering barely a few weeks of imports.

GDP growth: Recovery after the 2023 crisis was modest and uneven: the State Bank of Pakistan’s figures show real GDP fell −0.2% in FY2022–23, rebounded to 2.6% in FY2023–24, and reached a provisional 2.7% in FY2024–25. That slow, bumpy recovery, paired with very high inflation and weak industrial output, helps explain the disconnect: financial markets began pricing in stabilization, policy support, and renewed capital inflows well before most households saw any easing in prices or meaningful job and income improvements.

| Indicator | FY23 | FY24 | FY25 |

| Real GDP Growth (%) | -0.2 | 2.6 | 2.7 |

| Inflation Rate (CPI, % average) | 29.2 | 23.4 | 4.5 |

| Policy Interest Rate (end-period, %) | 22 | 20.5 | 11 |

| PKR / USD (end-period) | 278.22 | 278.52 | 280.23 |

| Current Account Balance (% of GDP) | -1 | -0.6 | 0.5 |

| SBP Foreign Exchange Reserves (US$ bn, end-period) | 4.45 | 9.39 | 14.51 |

Visualizing the Disconnect

| Year | KSE-100 Index (Year-End) | Annual Change (%) | Market Cap (PKR Trillion) | Inflation Rate (FY avg, %) | GDP Growth (FY, %) |

| 2023 | 62,451.04 | 54.50% | 9.06 | 29.2 | -0.2 |

| 2024 | 115,126.90 | 84.4 | 14.5 | 23.4 | 2.6 |

| 2025 | 174,054.32 | 51.2 | 19.69 | 4.5 | 2.7 |

The data shows how Pakistan’s stock market surged far ahead of the real economy. From 2023 to 2025, the KSE-100 index climbed from 62,451 to 174,054, with market capitalization more than doubling from PKR 9 trillion to nearly PKR 20 trillion. Annual gains of 54.5%, 84.4%, and 51.2% reflect strong investor confidence and expectations of stabilization. Yet GDP growth remained modest, moving from a contraction of −0.2% in FY23 to only 2.7% by FY25, while inflation fell sharply from 29.2% to 4.5%.

This disconnect highlights the forward-looking nature of equity markets. Investors anticipated stabilization, reforms, and liquidity improvements well before households experienced relief from inflation or saw meaningful growth in jobs and incomes. In essence, the stock market priced in recovery and policy credibility, while the real economy lagged behind, underscoring why financial indicators can sometimes appear detached from everyday economic realities.

IMF Programs and Their Market Impact

The 2023 Stand-By Arrangement (SBA) A pivotal moment came in July 2023 when Pakistan secured a $3 billion IMF Stand-By Arrangement. The program’s objectives were to stabilize the economy, restore investor confidence, and lay the groundwork for reforms. The immediate disbursement of $1.2 billion, along with inflows from partner countries, boosted foreign exchange reserves and stabilized the rupee. Bond spreads narrowed, and sovereign default risk receded.

Market Response The KSE-100 index reacted strongly. From around 38,000 in June 2023, it closed the year at 62,451, a gain of 54.5%. Market capitalization rose to PKR 9 trillion, while inflation averaged 29.2% and GDP contracted by −0.2%. Despite weak fundamentals, investors, both foreign and domestic, returned to equities, viewing the IMF program as a credible anchor.

Extended Fund Facility (EFF) and Beyond In September 2024, the IMF approved a 37-month Extended Fund Facility worth about $7 billion, tied to deeper structural reforms. This reinforced market confidence, signaling Pakistan’s commitment to a credible reform agenda.

Investor Sentiment The IMF’s involvement was seen as a “seal of approval.” The KSE-100 surged another 84.4% in 2024, closing at 115,126.90, with the market cap rising to PKR 14.5 trillion. By 2025, the index reached 174,054.32 (+51.2%), and the market cap expanded to nearly 20 trillion. Meanwhile, inflation fell sharply to 4.5%, and GDP growth recovered modestly to 2.7%.

This trajectory illustrates how IMF programs can drive market optimism well ahead of real economic recovery. Investors priced in stabilization and reforms, while households continued to face sluggish growth and delayed relief.

Currency Stabilization, Bond Spreads, and Interest Rates

Currency Dynamics

The rupee’s stabilization was a key catalyst for market confidence. After depreciating to a record low of 308 per US dollar in September 2023, the PKR stabilized around 280–290 following IMF disbursements and improved external inflows.

| Month | USD/PKR (Avg.) |

| Jan-23 | 233.84 |

| Sept-23 | 296.93 |

| Dec-23 | 278.22 |

Bond Yields and Interest Rates

Pakistan’s policy rate and government bond yields moved sharply as stabilization took hold. The SBP’s policy rate peaked at 22.0% in mid-2023 as the central bank tightened to anchor inflation and defend the currency; it was gradually eased through 2024 and 2025 and stood at 10.5% by early 2026.

The 10-year government bond yield tracked this easing: it was near crisis highs (around 14%) in mid-2023, fell to roughly 12% by the end of 2024, and declined further to about 11.2% by February 2026.

| Date | Policy Rate (SBP, %) | 10Y Govt Bond Yield (approx, %) |

| Jun-23 | 22 | ~14.0 |

| Dec-24 | 20 | ~12.0 |

| Feb-26 | 10.5 | 11.2 |

Lower policy rates and falling long-term yields raised the value of future corporate earnings, making stocks more attractive than bonds. Falling yields also signaled lower sovereign risk, which drew both local and foreign investors back into the market.

Behavioral Finance Drivers

The Psychology of Market Rallies

Behavioral finance offers crucial insights into why markets can rally amid economic distress. In Pakistan, several psychological factors played a role:

- Optimism Bias: Investors tend to overestimate the likelihood of positive outcomes, especially after policy interventions or external support.

- Herding Behavior: Many investors follow the crowd, buying into rallies for fear of missing out (FOMO), rather than conducting independent analysis.

- Overconfidence: Investors often overrate their ability to predict market movements, leading to excessive risk-taking and frequent trading.

Pakistan’s collectivist culture and low financial literacy amplify herding tendencies. Social influence, word-of-mouth, and reliance on “expert” opinions often outweigh fundamental analysis.

Implications for Investors

The gap between market prices and the real economy creates clear opportunities but also real dangers. Investors should act deliberately: balance exposure to capture upside, protect capital against sudden reversals, and match positions to their time horizon and goals.

Asset Allocation

Spread capital across equities, bonds, real estate, and cash. Keep equities for growth after deep corrections, but use high-quality bonds and cash to reduce volatility and preserve buying power. Rebalance after big moves to lock gains and prevent overconcentration.

Risk Management

Limit position sizes so a single loss cannot derail your plan. Use stop-losses or trailing stops, set clear exit rules before entering trades. Maintain a cash buffer to buy on pullbacks instead of selling into panic.

Time Horizon

Match investments to your goals. Hold growth assets for the long term to ride out volatility; treat short-term trades as active, higher-risk bets that require strict rules and discipline. Review your plan after major market shifts, not after every headline.

Valuation and Discipline

Buy based on valuations and earnings visibility, not momentum. Take profits in stages after sharp rallies and avoid emotional decisions driven by FOMO or crowd behavior.

Behavioral Checks

Watch your own biases. Pause before following hot tips, question herd signals, and stick to a written plan. Behavioral discipline often protects returns more than timing the market.

Conclusion

Policy support, external financing, and falling yields pushed investor confidence and lifted equity prices well before households felt relief. Behavioral forces, optimism, herding, and overconfidence amplified flows into stocks, creating upside but also vulnerability to sudden reversals. For investors, the lesson is clear: participate in recovery signals, but do so with valuation discipline, diversified allocations, and strict risk controls. Over the long run, sustained gains require real economic improvement; until then, sentiment can outpace fundamentals and reverse quickly.

Discover More about investing fundamentals

No responses yet