Introduction

Where does your money go? This is a common puzzle. Knowing every rupee spent helps you. You gain a powerful advantage. Manage your finances better. Digital wallets make this easier than ever.

Pakistan’s digital world is booming. Mobile wallets lead this change. Financial services are now more accessible. Digital transactions grew significantly. They went from 76% to 84% in Fiscal Year 2024. This expansion is largely driven by the increasing adoption of mobile banking and e-wallet usage across the country. Using financial tools is crucial now.

SadaPay and NayaPay lead this digital shift. These are top digital companions in Pakistan. They do more than send money or pay bills. They help you understand your money habits. This guide shows you how. Use SadaPay and NayaPay to control your money.

Why Tracking Spending is a Financial Superpower

Tracking your money is more than counting. It builds financial awareness. You gain discipline and control. This process answers where your funds disappear each month.

Benefits of Spending Tracking

- Know Your Money: Consistent tracking shows where your earnings go. You see your spending clearly. No more financial blind spots.

- Take Control: Awareness helps you make smart choices. Find “money leaks” and cut unnecessary costs.

- Reach Goals Faster: Want a new gadget? A family trip? An emergency fund? Understanding spending helps you. Set realistic goals. Achieve them quicker.

- Spot Errors Quickly: Digital wallets send instant updates. You see transactions right away. This helps find wrong charges fast. Spot suspicious activity quickly. Protect your money.

Simple Personal Finance Terms for Beginners

Let’s learn some basic money words. These terms help you on your financial journey.

- Income: This refers to any money an individual earns or receives, such as a salary, freelance payments, or gifts.

- Expenses: These are the amounts of money spent to acquire goods or services, representing all financial outflows.

- Fixed Expenses: These are costs that typically remain constant in amount over regular periods, such as monthly rent, loan installments, or recurring subscriptions.

- Variable Expenses: In contrast to fixed expenses, these costs fluctuate each month based on usage or choices. Common examples include dining out, shopping, and entertainment.

- Budgeting: This constitutes a financial blueprint, involving the advance planning of how money is anticipated to be spent and saved.

- Cash Flow: Simply defined, this is the movement of money received into an account and money spent from it. Tracking helps in comprehending this financial movement.

This vocabulary helps beginners. Simple terms make complex ideas easy. You grasp essential ideas fast. This helps you use app features better.

Table 1: Key Personal Finance Terms for Beginners

| Term | Simple Explanation | Example |

| Income | Money earned or received | Salary, freelance payments |

| Expense | Money spent | Groceries, phone bill |

| Fixed Expense | Costs that are the same every month | Rent, loan payment, Netflix subscription |

| Variable Expense | Costs that change month-to-month | Dining out, shopping, entertainment |

| Budgeting | Planning how to spend and save money | Using the 50/30/20 rule |

| Cash Flow | The movement of money in and out of an account | Tracking daily spending |

Digital Money: Understanding its Nature

Digital payment methods offer unparalleled convenience. Yet they can inadvertently render money somewhat abstract. This makes it feel less tangible compared to physical cash. When financial resources are purely figures on a screen, it can be challenging. New users might struggle to grasp their real value. By explicitly defining fundamental terms, this guide addresses this. It emphasizes tracking for awareness and control. This grounds digital transactions in financial concepts. It helps users connect numbers to their well-being. This understanding builds good money habits.

Meet Digital Wallet Companions: SadaPay & NayaPay

Pakistan’s fintech landscape has been significantly shaped. Two key players emerged: SadaPay and NayaPay. Each brings unique strengths.

Explore other Pakistani Finance Apps that are acing in 2025

SadaPay Overview

SadaPay entered the Pakistani market as a fintech innovator. It established an exclusive collaboration with Mastercard. Its core mission revolves around simplifying digital payments. It helps Pakistan’s substantial unbanked and underbanked population. It also alleviates payment challenges for freelancers and self-employed individuals.

The platform offers complimentary virtual and physical Mastercard debit cards. They are globally accepted for local and international transactions. Notably, SadaPay operates without monthly fees. Local transaction charges are free for transfers under PKR 10,000. Account holders get three free ATM withdrawals monthly. Use any ATM across Pakistan. Users frequently commend SadaPay for its intuitive and “simply brilliant” user experience. It streamlines financial management. The company also prides itself on its 24/7 customer support. It is provided by “real, friendly humans” rather than bots.

NayaPay Overview

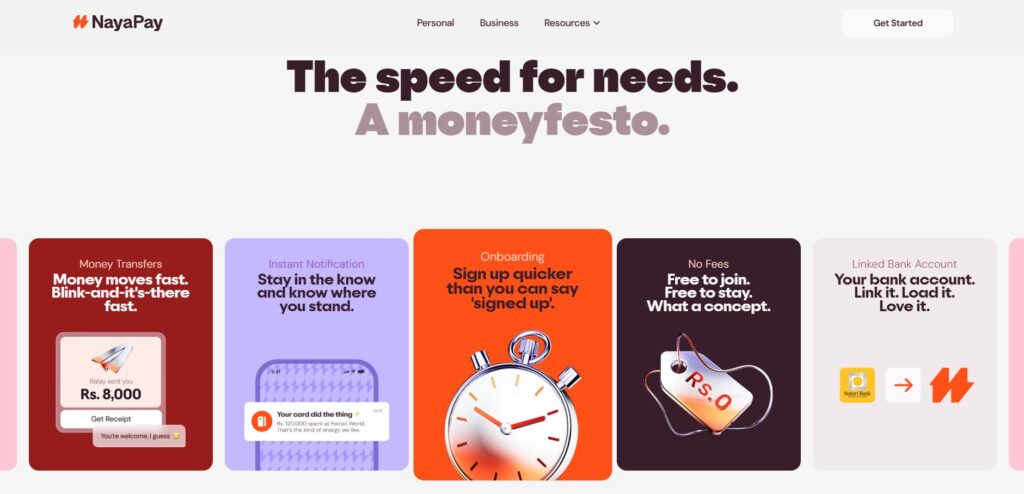

NayaPay marked a significant milestone. It was the first fintech entity in Pakistan. It secured an e-money license from the Central Bank. Its strategic vision is to evolve into a “super-app.” It combines messaging and digital payments. It primarily targets urban residents and tech-savvy youth.

Upon account creation, NayaPay provides a complimentary Visa virtual debit card. You can order a physical card for in-store purchases and ATM cash withdrawals. The platform emphasizes transparency. It adheres to a “free means free” policy. This means no hidden fees, annual charges, or SMS surcharges. NayaPay places a strong emphasis on security. It holds PCI DSS and ISO 27001 certifications. It also offers comprehensive in-app controls for card settings. This includes the ability to establish spending limits.

Strategic Market Positioning and User Experience for Financial Inclusion

SadaPay explicitly aims to serve the unbanked population and freelancers. This indicates a strong focus on basic financial access. It offers ease of use for a broad, underserved demographic. NayaPay also contributes to financial inclusion. It targets urban, tech-savvy youth. Its “super-app” concept integrates messaging features. Despite these nuanced differences, both simplify digital finance. They provide accessible tools.

SadaPay’s emphasis on the “simplest user experience” and NayaPay’s “chat-led platform” both underscore user-friendliness. This commitment is paramount for new users. Their core features support fundamental spending tracking. This makes both platforms ideal for beginners. The specific design may lead you to prefer one. Both offer significant value.

The underlying motivation for both companies is clear. They bridge Pakistan’s financial inclusion gap. They use user-friendly digital solutions. Their core features support spending tracking. This makes them perfect for new users.

SadaPay: A Step-by-Step Guide to Spending Tracking

SadaPay is engineered to provide “financial control in the palm of one’s hand.” Every transaction, whether an online purchase, a bill payment, or an in-store expenditure, can be “tracked conveniently using the app and via instant transaction notifications.” The platform delivers real-time updates for every financial movement—spending, sending, or receiving—ensuring immediate awareness of all money activities.

Accessing SadaPay Transaction History

- Open the SadaPay App: Begin by launching the SadaPay application on your smartphone.

- Log In Securely: SadaPay prioritizes security. Users can log into their account using biometric access (fingerprint or Face ID) or their personal PIN. Funds and sensitive personal data are protected through encryption.

- Navigate to the Dashboard/Home Screen: Upon successful login, you typically arrive at the main dashboard. This screen usually presents your current balance and a summary of recent activity.

- View Transaction History: Locate a section or tab commonly labeled “Recent Transactions,” “Activity,” or “Statement.” Tapping this will display a detailed, scrollable list of all past transactions.

- Explore Transaction Details: Each entry in the transaction history clearly indicates the merchant’s name, the date and time of the transaction, and the exact amount spent or received. SadaPay aims for complete transparency, with all charged fees explicitly shown on the transaction detail screen.

- Utilize Real-Time Notifications: This feature significantly enhances tracking capabilities. It is advisable to enable push notifications for the SadaPay application. These instant alerts for every spend, send, or receive action serve as a primary defense mechanism for monitoring money and promptly identifying any unusual or unauthorized activity.

Tips for Using SadaPay’s Data for Basic Budgeting

While SadaPay’s application does not currently offer advanced in-app categorization features comparable to specialized budgeting applications, you can still effectively categorize your spending manually.

Manual Categorization

Establishing a routine to review SadaPay transaction history is beneficial. Do it daily or at least weekly. A simple spreadsheet or a dedicated notebook can be used. Include columns for “Date,” “Amount,” “Merchant,” and “Category.” Examples are Groceries, Transport, Entertainment, Bills, Utilities. As transactions are reviewed, assign each to an appropriate category. This straightforward practice helps visualize major spending areas. It aligns with SadaPay’s own recommendation to track expenses. Divide them into “Fixed Expenses” and “Variable Expenses.” This empowers you to identify and understand your spending patterns.

SadaPay’s Budgeting Philosophy

SadaPay’s official blog actively promotes structured budgeting methodologies. Learn the 50/30/20 Rule or Zero-Based Budgeting. The transaction data from the SadaPay application can assess actual spending. See if it aligns with these principles. For instance, after categorizing expenses, check if 50% of income goes to needs. See if 30% goes to wants, and 20% to savings. This directly connects raw transaction data to actionable strategies. This process helps users transition from observing to actively managing.

SadaPay’s Holistic Ecosystem for Financial Literacy

SadaPay’s application provides robust core spending tracking features. Most notably, these are real-time notifications and a comprehensive transaction history. A significant aspect of its utility stems from its extensive blog. It explicitly educates users on budgeting methods. It covers expense tracking and broader money management principles.

The clear, accessible transaction data within the SadaPay application directly enables users. They can effectively apply budgeting and financial planning principles. These are detailed on SadaPay’s blog. Without the application’s granular tracking, budgeting advice would be theoretical. It would be harder for beginners to implement. Conversely, without educational content, users might not understand their data. This symbiotic relationship suggests SadaPay is more than a payment app. It operates as part of a broader ecosystem. It fosters financial literacy. It empowers users to gain greater control. This makes it a powerful tool for those starting their financial journey. It provides both data and the framework to use it.

NayaPay: Effortless Spending Insights at Your Fingertips

NayaPay is designed to assist users. It helps maintain control over finances. It offers a “detailed, easy-to-understand transaction history.” Furthermore, it streamlines “record-keeping” through “digital receipts” for transactions. Similar to SadaPay, NayaPay delivers “instant push notifications for every transaction.” This ensures immediate awareness of all incoming and outgoing funds.

Accessing NayaPay Transaction History & Digital Receipts

- Open the NayaPay App: Begin by launching the NayaPay application on your smartphone.

- Log In Securely: Access your account using fingerprint/Face ID or your MPIN (Mobile Personal Identification Number) for verification. NayaPay maintains high security standards. It is PCI DSS and ISO 27001 certified. This ensures secure transactions.

- Go to the Home Screen/Wallet: The main screen typically displays your current balance. It also shows a summary of recent financial activity.

- View Transaction History: Locate a section or tab usually labeled “Transactions” or “Activity.” Tapping this will reveal a comprehensive list of all payments, money transfers, and received funds.

- Review Digital Receipts: NayaPay explicitly highlights its “digital receipts” feature. To access these, simply tap on individual transactions within the history. This may provide additional details. It can include potentially linked digital receipts or invoices. These are valuable for detailed record-keeping and verifying purchases.

- Leverage Instant Notifications: This is a crucial tool for real-time tracking. It is important to ensure push notifications are enabled for the NayaPay application. These alerts are vital for monitoring spending as it occurs. They also help quickly identify any unauthorized activity or discrepancies.

Tips for Leveraging NayaPay’s Data for Financial Management

NayaPay’s detailed transaction history and digital receipts are convenient. Use them to create a robust and accurate record of spending. This is particularly advantageous for tracking larger purchases. It helps manage warranties or facilitate returns.

Proactive In-App Spending Limits

A notable feature of NayaPay is its capability. You can “set spending limits” for cards directly within the application. This serves as an effective proactive control mechanism. To implement this, review past spending using NayaPay transaction history. Identify areas prone to overspending. Subsequently, set a realistic daily, weekly, or monthly spending limit. Do this for your NayaPay card directly from the app. This feature moves beyond passive tracking. It enables active financial management. It aids adherence to a budget and prevents overspending.

Future Categorization Potential

NayaPay’s personal application does not explicitly mention in-app categorization. This is for individual transactions. However, NayaPay’s business platform, NayaPay Arc, incorporates advanced features. These include “dedicated Revenue and Expense accounts,” “reconciliation tools,” and “powerful filters and mind-reading search across transaction data points.” This suggests NayaPay possesses the technological capability. It could potentially implement more advanced categorization for personal users. For now, similar to SadaPay, manually categorize NayaPay transactions. Use a separate spreadsheet or notebook. Utilize the detailed history and digital receipts provided.

Proactive Control vs. Post-Facto Analysis in Digital Wallets

Both SadaPay and NayaPay excel at providing strong post-facto spending tracking. They offer detailed transaction histories and instant notifications. However, NayaPay distinguishes itself. It explicitly offers the ability to “set spending limits” for its cards directly within the application.

The inclusion of in-app spending limits in NayaPay allows users. They can proactively prevent overspending or adhere to a budget. This is better than reactively observing spending patterns. This shifts the user’s role. They become an active controller of their finances. It integrates a crucial budgeting function directly into the payment tool. Both applications are excellent for tracking. NayaPay offers a slightly more integrated and proactive approach. This particular feature may appeal to new users. They might require stronger guardrails. Or they prefer managing limits within their primary financial application.

SadaPay vs. NayaPay: Spending Tracking Features at a Glance

A comparison of spending tracking features reveals commonalities and distinct functionalities. This table provides a quick reference. Understand how each platform supports financial oversight.

| Feature | SadaPay | NayaPay |

| Real-time Transaction Notifications | ✅ Instant alerts for every transaction | ✅ Instant push notifications |

| Detailed Transaction History | ✅ Comprehensive list of past transactions | ✅ Detailed, easy-to-understand history |

| Digital Receipts/Invoices | Implied by “transparent fees on transaction detail” | ✅ Explicitly mentioned as “digital receipts” |

| In-App Spending Limits for Cards | ❌ Not explicitly mentioned for personal accounts | ✅ Explicitly mentioned for in-app card control |

| In-App Transaction Categorization | ❌ Not explicitly mentioned; official blog promotes manual categorization | ❌ Not explicitly mentioned for personal accounts; business platform suggests capability |

| Budgeting Guidance/Resources | ✅ Via official blog with budgeting methods | ❌ Not explicitly mentioned in provided snippets |

| Card Freeze/Unfreeze | ✅ In-app control | ✅ In-app control |

This comparative overview highlights core strengths. Both platforms excel in real-time notifications and detailed histories. These are fundamental for tracking. NayaPay has in-app spending limits. This helps proactive management. SadaPay offers budgeting guidance via its blog. Choose the app that fits your habits. Or use both for full control.

Level Up Spending Tracking: Beyond the Basics

Once you consistently review transactions, the next step is clear. Understand fund allocation by assigning categories. Use categories like Groceries, Transport, Entertainment, or Utilities. This practice is transformative for budgeting. Even if a digital wallet application does not offer automatic in-app categorization, you can still achieve this manually.

The Power of Categorization (Even if Manual)

Categorization is a game-changer for budgeting. To implement this, use a spreadsheet. A dedicated budgeting application, such as Hysab Kytab, or even a simple notebook works. Each week, review your SadaPay and NayaPay transaction histories. Assign a category to each expense. This shows your biggest spending areas. Find overspending. Make conscious adjustments. It turns raw transaction data into actionable insights for a personal budget.

A noticeable difference exists. Dedicated budgeting applications consistently highlight transaction categorization. It is a fundamental tool for effective spending tracking. SadaPay and NayaPay for personal accounts differ. While SadaPay’s blog actively promotes categorization, it implies a manual process. This indicates a feature gap. These popular digital wallets are excellent for transaction viewing. But they do not fully integrate categorization for personal users. Acknowledging this reality is essential. Provide practical, accessible workarounds like manual categorization. This ensures users apply best practices. It manages user expectations. It provides genuinely actionable advice.

Setting Spending Limits and Sticking to Them

Once a clearer picture of spending patterns emerges, set realistic limits. Do this for various expense categories. NayaPay offers a useful proactive control feature. It is the ability to “set spending limits” for its cards directly within the application. This functionality assists in adhering to a budget. It works even before expenses are incurred. For SadaPay users, self-discipline is necessary. Rely on manual tracking and a defined budget plan.

Regular Review and Adjustment

A budget should be viewed as dynamic. It adapts to life’s changes. Establish a routine for reviewing spending regularly. Perhaps weekly or monthly. Utilize the detailed transaction history in SadaPay or NayaPay. During this review, assess effective financial strategies. Identify overspending areas. Note any unexpected expenses. This consistent process builds long-term financial discipline. It is instrumental in achieving financial objectives.

Pro Tips & What to Keep in Mind

Navigating digital finance with SadaPay and NayaPay offers advantages. But a few considerations enhance the experience. They also safeguard financial well-being.

- Security First, Always: Both SadaPay and NayaPay implement robust security measures. These include biometric authentication (fingerprint/Face ID), data encryption, and even numberless cards. It is imperative to always utilize these features. Maintain phone security. Remain vigilant against phishing scams or suspicious communications.

- Understand Fees, Especially International: While both applications emphasize low or no local transaction fees, it is crucial to be aware of potential charges for international transactions. Some users have reported higher charges for international transactions with NayaPay. Always verify the transparent fee breakdown. It is displayed on the transaction screen. Do this before finalizing any payment, especially international purchases.

- Considering a Hybrid Approach for Savings: SadaPay and NayaPay are excellent for daily transactions. They are also great for spending tracking. But for substantial savings or long-term investments, some users suggest a hybrid approach. Maintain a traditional bank account with digital wallets. These digital wallets are highly effective for active spending. However, a traditional bank might offer more specialized savings or investment products. This is for long-term wealth accumulation.

- Customer Support is a Valuable Resource: Do not hesitate to seek assistance. Both SadaPay and NayaPay provide 24/7 customer support. Access it via in-app live chat or phone. Their teams help with transaction inquiries, issue resolution, or general clarifications.

- Privacy Matters: Recognize that digital wallets, like many applications, collect data. This concerns purchases, location, and usage patterns. Familiarize yourself with their privacy policies. Understand how personal data is handled.

Managing User Expectations and Risk Mitigation for Digital Finance Adoption

The core functionality of SadaPay and NayaPay is largely positive. It contributes to financial inclusion. However, real-world user experiences highlight potential challenges. These include account blocking due to specific transaction behaviors. Examples are repeated declines from free trials. Unexpected international transaction fees also occur. Failure to address these concerns could lead to negative experiences. This includes account suspension or unforeseen costs. Such outcomes erode trust. They impede consistent financial management.

A truly comprehensive and responsible guide for beginners must do more. It must instruct users on leveraging digital wallets for spending tracking. It must also teach judicious and secure use. By proactively addressing limitations and common issues, the guide builds credibility. It recommends best practices, like a hybrid banking approach. This equips the reader with knowledge to mitigate risks. It fosters a more sustainable and positive journey in digital finance.

Conclusion

The ability to track spending with SadaPay and NayaPay empowers individuals. They gain substantial control over their financial journey. Consistently review transactions. Utilize real-time notifications. Apply fundamental budgeting principles. Users acquire invaluable insights into their money habits.

This process extends beyond merely reducing costs. It cultivates financial awareness and discipline. Ultimately, it achieves genuine financial freedom and security. Embrace these digital tools. It represents a significant step towards smarter, more conscious spending.

No responses yet