ENGROH Corporation is one of Pakistan’s most influential conglomerates, with a diversified presence across agriculture, energy, petrochemicals, food, and digital infrastructure. Its decades-long legacy reflects resilience through economic cycles and strategic growth across key sectors. For investors, ENGROH offers both stability and long-term potential, serving as a lens into the broader industrial momentum shaping Pakistan’s economy. Whether you’re a seasoned investor or a curious market observer, analyzing ENGROH’s financials and strategic direction provides valuable insights into the broader trends driving Pakistan’s corporate sector.

Read fundamental analysis of other stocks listed on PSX and much more!

Company Overview

ENGROH Corporation, originally founded in 1965 as Esso Pakistan Fertilizer Limited, rebranded in 1991 after a landmark management buyout and has since evolved into one of Pakistan’s leading industrial conglomerates. Operating through subsidiaries like Engro Fertilizers, Engro Polymer & Chemicals, Engro Energy, Engro Enfrashare, and Engro Vopak, the company plays a vital role across agriculture, energy, petrochemicals, and telecom infrastructure. Its fertilizer division remains central to supporting Pakistan’s farming sector, while investments in Thar coal and telecom towers reflect ENGROH’s push toward energy independence and digital connectivity. With a strong focus on sustainability and ESG standards, ENGROH continues to position itself as a forward-looking, socially responsible enterprise.

Recent Financial Performance

ENGROH Corporation has shown steady financial growth over the past six years, balancing its core strength in fertilizers with expansion into energy and infrastructure. Despite economic challenges, it has maintained solid margins and delivered consistent shareholder returns. The following analysis explores key trends in revenue, profitability, and asset management that define ENGROH’s investment appeal.

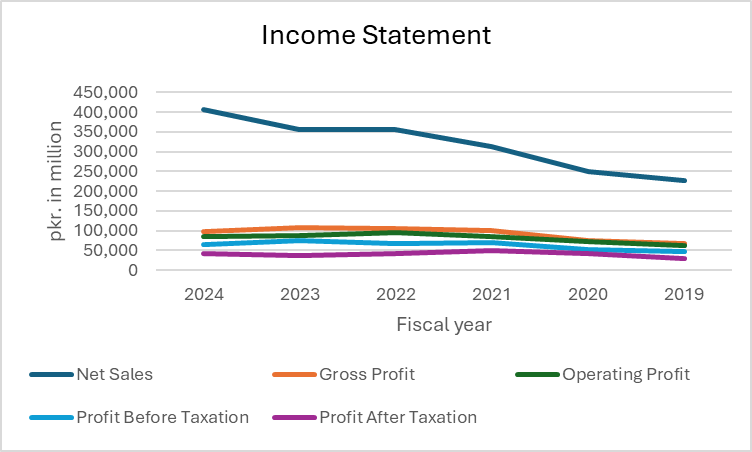

Income Statement:

| Income Statement | ||||||

| Item | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 |

| Net Sales | 406,167 | 356,742 | 356,643 | 311,781 | 248,950 | 225,765 |

| Gross Profit | 97,675 | 107,273 | 104,682 | 99,391 | 76,081 | 68,599 |

| Operating Profit | 83,981 | 87,355 | 94,469 | 85,009 | 71,555 | 62,096 |

| Profit Before Taxation | 65,872 | 75,470 | 66,598 | 70,259 | 52,859 | 47,068 |

| Profit After Taxation | 43,245 | 36,874 | 42,920 | 50,735 | 42,351 | 29,787 |

ENGROH’s revenue has maintained a strong upward trajectory, increasing from PKR 225 billion in 2019 to PKR 406 billion in 2024. This growth was fueled by solid performance in its fertilizer and energy segments, supported by strategic investments and operational scale. While gross and operating profits peaked around 2022–23, a dip in 2024 suggests margin pressure, likely due to rising input costs and pricing constraints. Despite fluctuations in pre-tax earnings, profit after tax remained resilient, recovering to PKR 43 billion in 2024 after a brief decline. Overall, ENGROH’s financials reflect a stable yet competitive position, with consistent profitability and diversified revenue streams across its industrial portfolio.

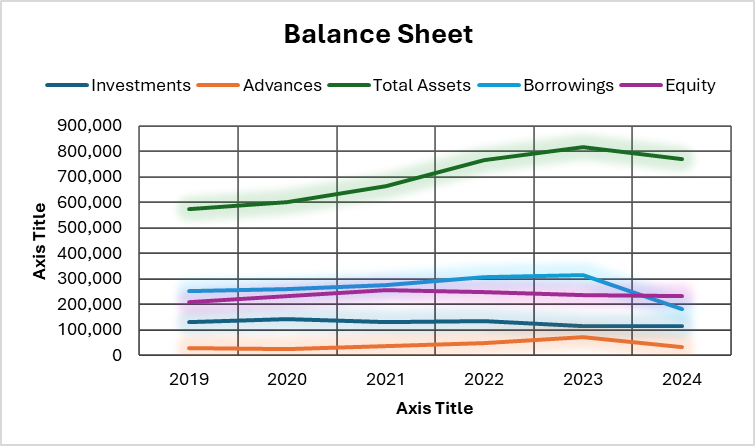

Balance Sheet:

| Balance Sheet | ||||||

| Item | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 |

| Investments | 112,495 | 113,115 | 133,157 | 130,120 | 139,694 | 127,868 |

| Advances | 32,157 | 69,059 | 49,085 | 33,871 | 25,326 | 26,346 |

| Total Assets | 769,337 | 815,792 | 765,538 | 662,702 | 601,130 | 573,639 |

| Borrowings | 180,970 | 312,509 | 307,204 | 274,253 | 260,268 | 250,305 |

| Equity | 232,119 | 234,954 | 248,660 | 253,991 | 231,662 | 208,045 |

ENGROH’s balance sheet over the past six years reflects both growth and strategic shifts. Total assets rose from PKR 573 billion in 2019 to a peak of PKR 816 billion in 2023, before easing to PKR 769 billion in 2024—driven by reduced advances and investment activity. Investments remained relatively stable, while advances showed volatility, peaking in 2023 and dropping sharply in 2024. Borrowings increased steadily until 2023 but declined significantly in 2024, suggesting a move toward deleveraging. Equity strengthened consistently, rising to PKR 232 billion in 2024, underscoring ENGROH’s ability to preserve shareholder value despite fluctuations in asset and debt levels.

Valuation Metrics & Ratios

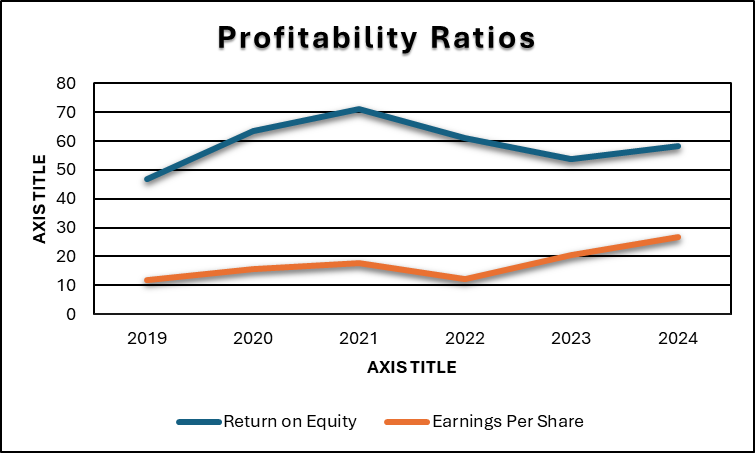

Profitability Ratios

| 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | |

| Return on Equity | 58.42% | 53.94% | 61.17% | 71.07% | 63.34% | 46.99% |

| Earnings Per Share | 26.78 | 20.67 | 12.19 | 17.71 | 15.76 | 11.75 |

ENGROH’s profitability ratios reflect strong shareholder returns and consistent earnings growth. Return on Equity remained robust throughout, peaking at 71.07% in 2021 and stabilizing at 58.42% in 2024 indicating efficient capital use. Earnings Per Share showed a steady upward trend, rising from PKR 11.75 in 2019 to PKR 26.78 in 2024, driven by solid operational performance and strategic expansion

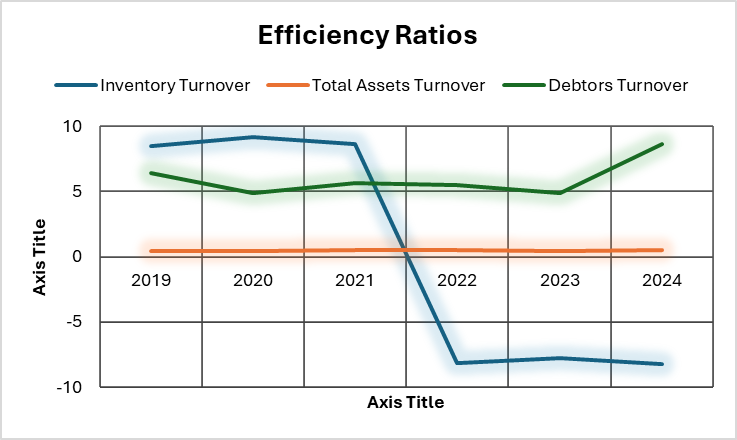

Efficiency Ratios

| 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | |

| Inventory Turnover | -8.24 | -7.8 | -8.16 | 8.59 | 9.13 | 8.46 |

| Total Assets Turnover | 0.53 | 0.44 | 0.47 | 0.47 | 0.46 | 0.43 |

| Debtors Turnover | 8.61 | 4.86 | 5.45 | 5.65 | 4.85 | 6.41 |

ENGROH’s asset utilization remained steady, with Total Assets Turnover improving from 0.43 in 2019 to 0.53 in 2024, indicating better revenue generation per unit of assets. Debtors Turnover fluctuated but rose sharply to 8.61 in 2024, suggesting improved collection efficiency. However, Inventory Turnover turned negative from 2022 onward, which may reflect valuation adjustments or operational inefficiencies in inventory management that warrant closer scrutiny.

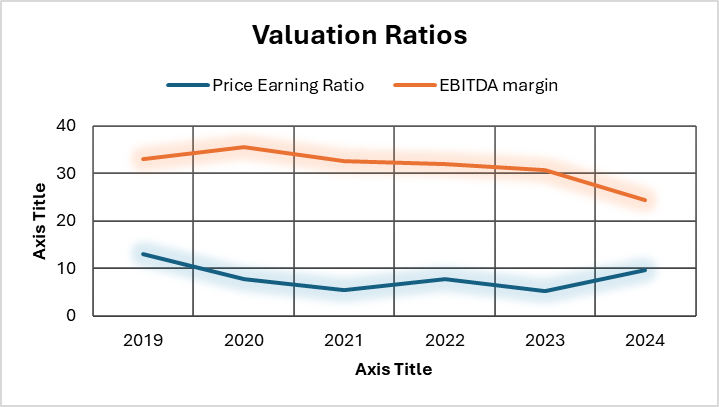

Valuation Ratios

| 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | |

| Price Earning Ratio | 9.7 | 5.21 | 7.75 | 5.39 | 7.71 | 13.12 |

| EBITDA margin | 24.44 | 30.69 | 32 | 32.56 | 35.6 | 33.08 |

ENGROH’s P/E ratio fell from 13.12 in 2019 to 5.21 in 2023, then rebounded to 9.7 in 2024, signaling undervaluation and renewed investor confidence. EBITDA margins dropped from 35.6% to 24.4%, highlighting rising costs and operational strain. Profitability persists, but efficiency concerns may affect future valuations.

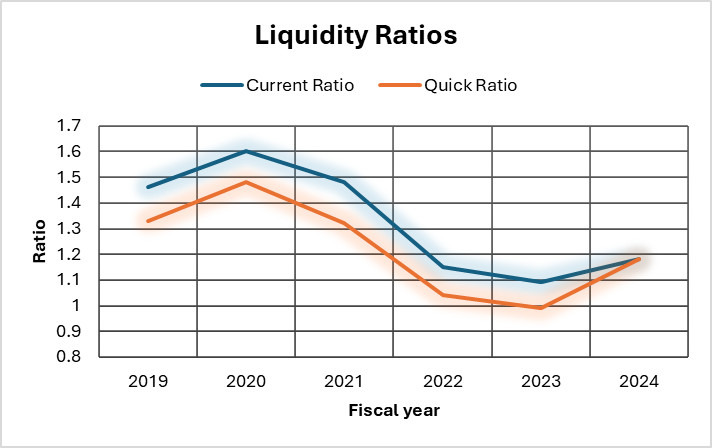

Liquidity Ratios

| 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | |

| Current Ratio | 1.18 | 1.09 | 1.15 | 1.48 | 1.6 | 1.46 |

| Quick Ratio | 1.18 | 0.99 | 1.04 | 1.32 | 1.48 | 1.33 |

ENGROH’s liquidity remained adequate but showed tightening trends. The Current Ratio fell from 1.60 in 2020 to 1.09 in 2023, then rose to 1.18 in 2024, signaling slight recovery. The Quick Ratio dipped below 1.0 in 2023, but improved to 1.18, reflecting better cash and receivables control.

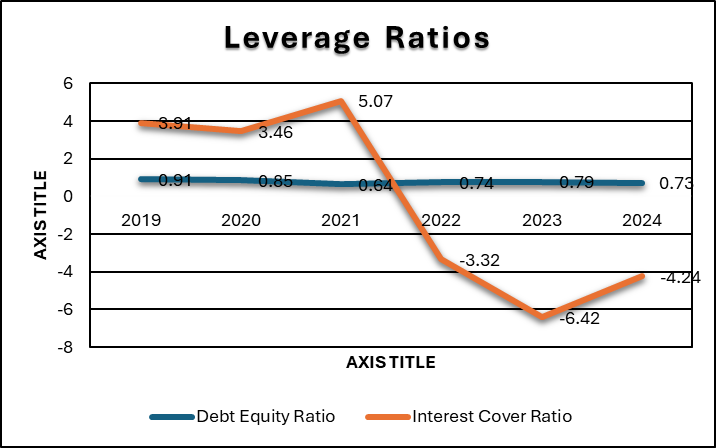

Leverage Ratios

| 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | |

| Debt Equity Ratio | 0.73 | 0.79 | 0.74 | 0.64 | 0.85 | 0.91 |

| Interest Cover Ratio | -4.24 | -6.42 | -3.32 | 5.07 | 3.46 | 3.91 |

ENGROH’s capital structure has remained moderately leveraged, with the Debt-to-Equity Ratio declining from 0.91 in 2019 to 0.73 in 2024. This indicates a gradual shift toward a more balanced financing mix, though debt levels remain significant. However, the Interest Cover Ratio shows a concerning trend—positive until 2021, but turning negative from 2022 onward. This suggests that operating profits were insufficient to cover interest expenses in recent years, raising red flags about debt servicing capacity and financial risk.

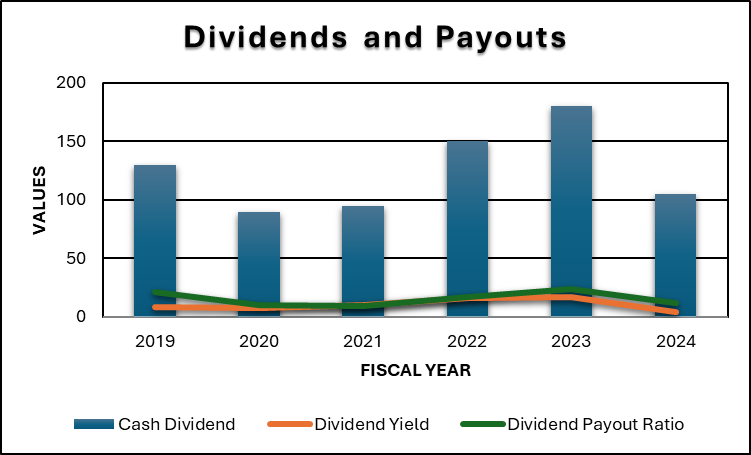

Dividend & Payout History

| 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | |

| Cash Dividend | 105 | 180 | 150 | 95 | 90 | 130 |

| Dividend Yield | 4.04 | 16.72 | 15.87 | 9.95 | 7.4 | 8.43 |

| Dividend Payout Ratio | 11.69 | 23.49 | 16.82 | 9.01 | 10.16 | 20.8 |

ENGROH’s dividend performance over the years reflects a mix of consistency and strategic recalibration. Cash dividends fluctuated, peaking at PKR 180 in 2023 before dropping to PKR 105 in 2024. Despite these shifts, the company maintained attractive dividend yields, especially in 2022 and 2023, reaching 15.87% and 16.72% respectively highlighting strong shareholder returns during those periods.

The dividend payout ratio varied significantly, ranging from just over 9% in 2021 to 23.49% in 2023. This suggests ENGROH’s flexible approach to balancing reinvestment needs with rewarding shareholders. The lower payout in 2024 may indicate a strategic focus on retaining earnings for future growth, debt reduction, or operational resilience.

Financial Risk Management Overview

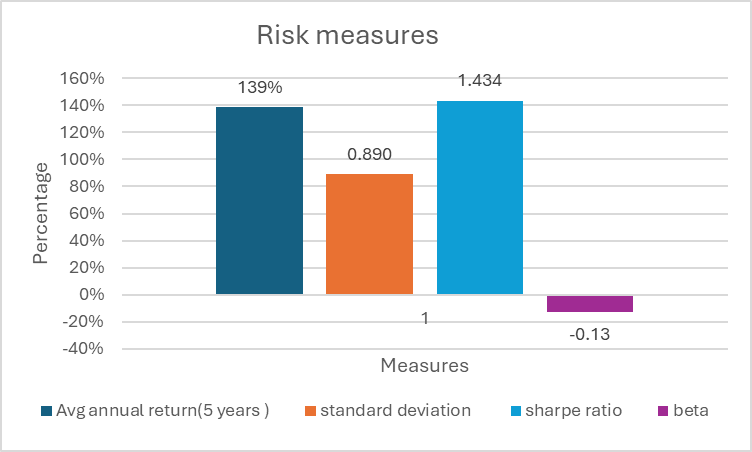

| Avg. annual return(5 years ) | 139% |

| standard deviation | 0.890 |

| Sharpe ratio | 1.434 |

| beta | -0.13 |

ENGROH has delivered exceptional performance, achieving a five-year average annual return of 139%. Its Sharpe ratio of 1.434 highlights strong risk-adjusted returns, while a standard deviation of 0.890 reflects controlled volatility. Notably, the company’s beta of –0.13 shows a low correlation with the overall market, emphasizing its resilience in different conditions. Risk management is a central focus, guided by ENGROH’s Finance and Planning Department through structured policies. Currency exposure is managed with forward contracts and prepayments, where a 1% exchange rate shift impacts profit by Rs. 3,880. Interest rate risk is more significant, as a 1% change in variable borrowings affects profit by Rs. 159,742. Price fluctuations in mutual fund investments also pose sensitivity of Rs. 17,605. Credit risk is minimized by dealing with reputable counterparties and securing receivables, while liquidity is maintained through credit lines and cash flow forecasting. Together, these measures ensure stability and sustainable growth.

Industry & Market Position: ENGROH

1. Market Share & Competition

ENGROH Corporation remains one of Pakistan’s most influential industrial conglomerates, with a diversified footprint across fertilizers, energy, petrochemicals, food, and telecom infrastructure. Its fertilizer arm produced over 2.4 million metric tons of urea in 2024, maintaining its position as a market leader in agricultural inputs. In telecom infrastructure, Engro Enfrashare has deployed 4,125 towers, supporting Pakistan’s digital expansion.

2. Sector Diversification & Strategic Role

ENGROH’s portfolio includes high-impact sectors that contribute directly to national development. Engro Energy supplies power to over 2 million households, while Engro Elengy Terminal handles approximately 15% of Pakistan’s natural gas supply. Its petrochemical subsidiary, Engro Polymer & Chemicals, supports industrial self-reliance through local PVC and VCM production, contributing USD 81 million in import substitution. This diversification not only buffers ENGRO against sector-specific risks but also aligns it with Pakistan’s infrastructure and sustainability goals.

3. Competitive Positioning

ENGROH faces competition from specialized players in each sector but leverages its brand equity, financial strength, and strategic partnerships to stay ahead. Its energy and telecom ventures benefit from long-term infrastructure investments, while its fertilizer and chemical divisions capitalize on economies of scale. With a focus on innovation, inclusive growth, and operational excellence, ENGROH continues to reinforce its position as a cornerstone of Pakistan’s industrial economy.

Management & Governance of ENGROH

1. Leadership Structure

ENGROH is led by a seasoned and visionary leadership team, anchored by Chairman Hussain Dawood and CEO Abdul Samad Dawood, who also serves as Vice Chairman. The Board of Directors includes a mix of executive and independent members, such as Sabrina Dawood, Muhammed Amin, Isfandiyar Shaheen, Ahmed Ebrahim Hasham, and Sohail Tai. This diverse board ensures strategic oversight, ethical governance, and long-term value creation.

2. Executive Management

ENGROH’s operational leadership spans across its subsidiaries, each headed by specialized CEOs. Notable names include Ali Rathore (Engro Fertilizers), Athar A. Khwaja (Engro Energy), Faisal Sattar (Engro Enfrashare), and Syed Ammar Shah (Engro Vopak & Elengy Terminals). The corporate CFO, Farooq Barkat Ali, oversees financial strategy across ENGRO Holdings and ENGRO Corp, ensuring fiscal discipline and transparency.

3. Governance Framework

ENGROH adheres to the Listed Companies (Code of Corporate Governance) Regulations, 2019, with dedicated committees for audit, HR & remuneration, and investment oversight. The Board Audit Committee is chaired by Shabbir Hussain Hashmi, while the HR & Remuneration Committee is led by Isfandiyar Shaheen. These structures promote accountability, risk management, and ethical decision-making.

News & Announcements: ENGROH

1. Corporate Restructuring & Creation of Engro Holdings

Effective January 1, 2025, ENGROH underwent a major structural shift under a Scheme of Arrangement, resulting in the creation of Engro Holdings Limited as the new parent entity. ENGRO Corporation is now a wholly owned subsidiary, and profit attributable to shareholders reflects 100% of ENGROH’s earnings compared to 39.97% previously. This move consolidates control and streamlines reporting across the group’s industrial portfolio.

2. Acquisition of Deodar Telecom Towers

On June 3, 2025, ENGROH completed the acquisition of Deodar, a telecom infrastructure company owning approximately 10,600 towers, from PMCL. The assets and liabilities were recognized at provisional fair values of PKR 220.6 billion and PKR 167.7 billion, respectively. Deodar’s results for the 28-day period ending June 30 were included in the half-year accounts. This represents a major strategic move for ENGROH, broadening its presence across Pakistan’s digital infrastructure landscape.

3. Reversal of Thermal Energy Asset Impairment

After ending its divestment plans in April 2025, ENGROH shifted its thermal energy assets back into the category of ongoing operations. This led to a reversal of previously recognized impairment, amounting to PKR 53.76 billion, with PKR 26.57 billion attributable to shareholders. While this boosted reported earnings, it was a one-off adjustment and not reflective of underlying operational growth.

4. Dividend Strategy & Earnings Impact

For the first half of 2025, ENGRO Holdings posted a consolidated Profit After Tax of PKR 73.3 billion, with earnings per share climbing to PKR 29.54—up from PKR 8.09 during the same period in 2024. However, excluding the one-off impairment reversal, PAT stood at PKR 19.56 billion, and EPS at PKR 9.00. The Board opted not to declare an interim dividend, prioritizing funding for the Deodar acquisition and long-term shareholder value creation.

Conclusion

ENGROH Corporation has demonstrated resilience and strategic foresight across a dynamic six-year period. Its diversified operations from fertilizers and energy to telecom infrastructure have enabled consistent revenue growth and positioned the company as a key contributor to Pakistan’s industrial development. Recent structural changes, including the formation of Engro Holdings and the acquisition of Deodar Telecom, signal a bold shift toward consolidation and digital expansion. While short-term earnings have been influenced by one-off adjustments, ENGROH’s governance strength, sectoral reach, and long-term strategy suggest a solid foundation for sustainable growth and shareholder value.

No responses yet