Introduction: The Comfort of Saving, but at What Cost?

In Pakistan’s fluctuating economic environment, millions of people rely on savings accounts to keep their money safe and earn modest returns. This approach is traditional, widely practiced, and perceived as a low-risk way to manage finances. For many, the reassurance of seeing a stable account balance outweighs the uncertainty of more volatile investment options. However, it’s essential to recognize the hidden cost of this choice particularly how inflation steadily eats away at the purchasing power of your money over time.

Savings accounts are widely considered a secure and straightforward way to grow money, yet with inflation steadily rising at 4.1% as of mid-2025, the actual value of money held in these accounts is affected in ways many don’t realize.

The nominal profit rates offered by Pakistan’s leading banks average around 9.5%, but inflation reduces the purchasing power of the returns earned. Understanding the relationship between these figures reveals how much savings truly grow or shrink in real terms over the years.

Understanding the Numbers: Nominal Returns vs. Real Returns

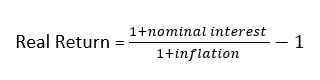

When you deposit money in a savings account, the bank offers you a profit rate — commonly referred to as the nominal return. But nominal returns alone don’t tell the full story. Inflation, which measures how prices increase over time, reduces the real value of your money.

Think of inflation as the “invisible tax” on your savings it raises the prices of goods and services, meaning a rupee today buys less in the future. To truly understand how your savings grow, you must calculate the real return, which is the nominal return adjusted for inflation.

The formula is simple:

For instance, if your savings account pays a 9.5% profit annually, but inflation is 4.1%, your real return is approximately 5.2%

Historical Context: Inflation in Pakistan

Pakistan has experienced multiple periods of high inflation, with rates frequently surpassing 10% and, at times, exceeding 20%. A notable example occurred in 2023, when inflation surged to over 28.3%, driven by steep currency devaluation, rising energy costs, and an upswing in global commodity prices. Such extreme price growth significantly erodes the purchasing power of money. Even savings accounts offering 18%–20% annual profit rates may appear lucrative at first glance, but when adjusted for inflation, they can still result in negative real returns.

In other words, the actual value of your savings decreases despite earning interest or profit. This disconnects between nominal and real returns highlights why simply relying on traditional savings instruments during high-inflation periods can be risky. To preserve and grow wealth, it becomes crucial to explore options that have the potential to outperform inflation over time, such as diversified investments or inflation-linked instruments.

What Does Pakistan’s Financial Landscape Look Like in 2025?

Pakistan’s economy is on a cautious path of stabilization. Inflation, which soared to alarming highs in recent years, has moderated significantly. As of July 2025, the Consumer Price Index (CPI) inflation rate stands at 4.1% annually – a relief for many consumers and savers.

At the same time, Pakistan’s top banks are offering profit rates on savings accounts hovering around 9.5% to 9.6%, based on official mid-2025 data. Let’s examine these rates from the country’s five largest banks:

| Bank | Profit Rate (PLS Savings) % |

| Habib Bank Limited (HBL) | 9.50% |

| National Bank of Pakistan (NBP) | 9.50% |

| United Bank Limited (UBL) | 9.50% |

| MCB Bank Limited | 9.50% |

| Allied Bank Limited (ABL) | 9.50% |

| Bank AL Habib | 9.60% |

These rates reflect the Profit and Loss Sharing (PLS) model common in Pakistani banking, where returns fluctuate based on the bank’s profit.

Discover how the fluctuating Pakistani Rupee is affecting you

Calculating Your Real Return: What Do These Numbers Mean?

The average nominal profit rate from these banks is roughly 9.52% annually. Subtracting the current inflation rate of 4.1%, we arrive at an approximate real return of 5.2%.

| Metric | Percentage (%) |

| Average Nominal Return | 9.52 |

| Current Inflation Rate | 4.1 |

| Approximate Real Return | 5.2 |

This means that after accounting for inflation, your money grows in purchasing power by about 5.2% per year

Why This Matters

When planning for the future, it’s important to remember that you don’t spend in nominal terms you spend in real terms. The money in your account may grow year by year, but so do the prices of the goods and services you plan to buy. Whether you’re saving for a car, a child’s education, or a comfortable retirement, the actual cost of these goals will inevitably rise over time due to inflation. Ignoring this reality can leave you short of your target, making it essential to focus on the real value of your savings, not just the nominal figures.

The Psychological Trap

Many savers fall victim to the “money illusion”. Money illusion is a cognitive bias where we focus on the nominal value of money rather than its purchasing power. Watching your account balance increase can feel satisfying and even reassuring, but this growth can be misleading if inflation outpaces your returns. If the cost of living rises faster than your savings grow, the actual worth of your money shrinks, even if your account balance appears healthy. This silent erosion of wealth is why understanding and accounting for inflation is critical for anyone serious about preserving their financial future.

The Role of Compounding

In finance, compounding is frequently referred to as the “eighth wonder of the world. But here’s the catch: inflation compounds too. This means that just as your savings grow faster over time, so does the erosion of purchasing power.

Example:

If inflation is 4% annually, after 5 years, prices are not just 20% higher they’re about 21.7% higher due to compounding.

A Real-Life Example: What Happens to Rs. 100,000 Over 5 Years?

Let’s bring the numbers to life.

Let’s say you deposit Rs. 100,000 into your savings account today. With a 9.52% annual profit rate (compounded yearly), your money would grow steadily:

By the end of Year 1, your balance would reach Rs. 109,520.

After 5 years, it would climb to approximately Rs. 157,779

At first glance, this looks like a healthy ~58% increase in your total balance over five years. But here’s the catch, inflation quietly works in the background, reducing what that money can actually buy.

If prices of goods and services rise by 4.1% each year (a realistic average in Pakistan’s recent trend), your savings don’t retain the same value in real terms. Adjusting for inflation, your real purchasing power after 5 years would be closer to Rs. 128,852.

In other words, while your account balance on paper shows a strong gain, the actual buying power of your money has grown by only about ~29%. This highlights a critical truth: nominal gains and real gains are not the same, and inflation can quietly take a significant bite out of your long-term savings growth.

Year-by-Year Breakdown

| Year | Nominal Value(₨) @ 9.52% | Real Purchasing Power (₨) @ 5.2% |

| 0 | 100,000 | 100,000 |

| 1 | 109,520 | 105,200 |

| 2 | 119,948 | 110,670 |

| 3 | 131,381 | 116,425 |

| 4 | 143,949 | 122,482 |

| 5 | 157,779 | 128,852 |

Protecting Your Savings from Inflation

While a savings account is important for liquidity and emergencies, relying solely on it for long-term growth can be risky. Here are a few strategies to consider:

- Diversify Your Investments

Include a mix of asset classes like equities, mutual funds, ETFs, real estate, and gold to balance risk and return. - Consider Inflation-Linked Investments

Certain government bonds and investment products are designed to keep pace with inflation. - Use Tiered Saving

Keep short-term needs in a savings account but invest surplus funds for higher potential returns. - Regularly Review Your Returns vs Inflation

Compare your account’s annual profit rate to Pakistan’s inflation rate to see your real return

Conclusion: Knowing the True Cost of Saving in Pakistan

Parking your money in a savings account in Pakistan today will give you modest purchasing power growth roughly 5.4% annually after inflation. This is decent in a historically inflation-prone economy but far from wealth-creating.

To truly grow your wealth, understanding how inflation erodes nominal returns is vital. When inflation rises, the gap between your nominal returns and real purchasing power narrows sometimes even turning negative. That’s the real cost of “safe” saving.

For most Pakistanis, savings accounts remain a vital tool for liquidity and short-term security. But for long-term growth, diversifying into higher-yielding instruments balanced with risk tolerance is key.

Make informed choices, keep an eye on inflation trends, and always ask: Is my money growing in real terms, or just nominal numbers?

No responses yet