Introduction: A Common Dilemma: Where Should I Invest?

Imagine standing at a financial crossroads. You’ve saved some money … perhaps from your first job, a bonus, or years of disciplined budgeting. You’re ready to invest, but one question lingers: Where do I begin? You hear your friends raving about the stock market, your banker suggests mutual funds, and now social media is buzzing about ETFs.

If you’ve ever felt overwhelmed by these choices, you’re not alone. Knowing how mutual funds, stocks, and ETFs differ is essential for making smart, well-informed investment choices.

The financial market in Pakistan has become increasingly accessible in recent years. With a growing number of brokerage apps, digital investment platforms, and regulated products on the Pakistan Stock Exchange (PSX), even first-time investors can enter the market with as little as a few hundred rupees. Yet, despite this democratization of investing, confusion remains high. Terms like “risk-adjusted returns,” “expense ratios,” or “market volatility” may seem intimidating, and social media is full of conflicting advice.

The Passive Path: Mutual Funds and Their Quiet Power

Mutual funds are like hiring a professional driver to navigate the financial highway for you. Investing in a mutual fund means your money is combined with funds from other investors and professionally managed by a fund manager. This manager decides which securities to buy or sell, aiming to meet the fund’s investment goals.

Mutual funds have seen strong growth in Pakistan, with providers such as UBL Funds, HBL Asset Management, and Al Meezan offering a wide variety of options. Choices range from low-risk money market funds to high-risk aggressive equity funds, and even Shariah-compliant options for investors seeking ethical alignment.

Mutual funds in Pakistan offer easy entry, starting from just PKR 500, with professionals managing your investment. However, annual fees (2–3%), possible sales loads, and market volatility can impact returns.

The Power Play: Stocks for Those Willing to Take the Reins

Now picture yourself in the driver’s seat, hands on the wheel, eyes on the road—you’re investing in stocks. Here, you own a piece of a company—say Lucky Cement, Meezan Bank, or Engro Corporation—and your success depends on the company’s performance and market demand.

Stocks traded on the Pakistan Stock Exchange (PSX) offer significant upside potential. Historically, top-performing stocks on the PSX have delivered CAGR 28.1% over a 5year period, outperforming most mutual funds.

But this freedom isn’t free of pressure. You’ll have to watch the market closely, keep up with the news, dig into financial reports, and be ready to act fast. Mistakes can be costly. Stocks are also subject to brokerage commissions (~0.5%) and taxed under Capital Gains Tax (CGT) at 15% if held for less than one year.

The Middle Ground: ETFs – A Smart Blend of Control and Convenience

While still a newcomer to Pakistan’s financial market, Exchange-Traded Funds (ETFs) have been a favorite among global investors for years. They function like mutual funds but are traded on the stock exchange just as easily as individual stocks. You can buy or sell them at any time during market hours, and they typically carry lower expense ratios. PSX currently offers a few ETFs, such as:

- UBL Pakistan Enterprise ETF

- HBL Total Treasury ETF

- Meezan Pakistan ETF

ETFs follow a group of stocks, offering investors instant diversification in a single trade. For example, if an ETF tracks the KSE-30 Index, your investment spreads across 30 companies rather than just one.

For investors seeking low fee For investors seeking low fees, real-time trading, and built-in diversification, ETFs offer an ideal middle ground. Still, their growth in Pakistan is slowed by the limited number of ETFs listed on the PSX and low public awareness, real-time trading, and built-in diversification; ETFs offer an ideal middle ground. Still, their growth in Pakistan is slowed by the limited number of ETFs listed on the PSX and low public awareness.

Returns Comparison: Mutual Funds vs Stocks vs ETFs in Pakistan

Over the past decade, Pakistani investors have experienced dramatically different returns across asset classes, driven by interest rate cycles, political volatility, and structural market shifts. Let’s dive into a side-by-side comparison based on 3-5 years of verified return data across Mutual Funds (Money Market, Income, and Equity), Stocks (KSE-100 Index), and Exchange Traded Funds (ETFs).

Mutual Funds – Stability Meets Strategy

Mutual funds, professionally managed by AMCs (Asset Management Companies), offer a range of risk and return profiles based on asset classes: Money Market, Income, and Equity Funds.

Money Market Funds (Low-Risk, Stable Returns)

| Bank | Fund Name | FY2025 | FY2024 | FY2023 | FY2022 | FY2021 | 5-Year Average |

| Meezan | MCF | 13.34% | 21.22% | 16.11% | 9.00% | 5.81% | 13.10% |

| UBL | UMMF | 14.70% | 22.00% | 16.40% | 9.40% | 6.30% | 13.76% |

| HBL | HBL MMF | 14.05% | 21.54% | 16.66% | 10.26% | 6.84% | 13.87% |

Income Funds (Moderate Risk, Steady Income)

| Bank | Fund Name | FY2025 | FY2024 | FY2023 | FY2022 | FY2021 | 5-Year Average |

| Meezan | MIIF | 12.54% | 20.94% | 14.86% | 8.63% | 6.64% | 12.32% |

| UBL | UGSF | 19.20% | 21.10% | 15.40% | 9.10% | 5.60% | 14.88% |

| HBL | HBL Income | 13.38% | 22.35% | 17.03% | 11.43% | 7.10% | 14.26% |

Equity Mutual Funds (Higher Risk, Long-Term Growth)

| Bank | Fund Name | FY2025 | FY2024 | FY2023 | FY2022 | FY2021 | 5-Year Average |

| Meezan | MIF | 59.22% | 73.00% | -2.54% | -11.27% | 35.50% | 30.38% |

| UBL | USF | 72.20% | 91.60% | -0.40% | -11.50% | 31.70% | 36.32% |

| HBL | HBL Stock | 36.73% | 85.59% | -3.15% | -35.84% | 29.83% | 22.63% |

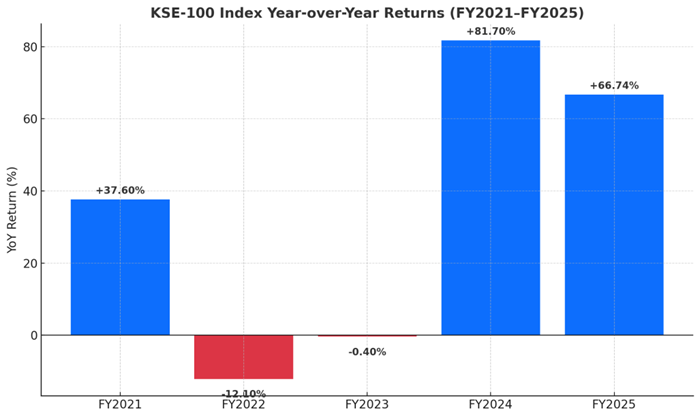

Stocks – KSE‑100 Index Returns

Investing directly in stocks can potentially outperform all mutual funds—but comes with higher risk and effort. The KSE‑100 Index, a benchmark for Pakistan’s top companies, reflects market-wide performance.

| Fiscal Year | KSE‑100 Year-End | YoY Return |

| FY2021 | 47,356.02 | +37.60% |

| FY2022 | ~41,631 | –12.10% |

| FY2023 | 41,452.69 | –0.40% |

| FY2024 | 75,342.69 | +81.70% |

| FY2025 | 125,627.31 | +66.74% |

5-Year CAGR (Approx.): 28.1%

Best for: Active investors with knowledge, time, and a high-risk appetite.

ETFs – Market-Like Returns, Simpler Access

Exchange Traded Funds (ETFs) are relatively new in Pakistan but growing fast. These funds mirror index performance while offering diversification, lower fees, and easy trading on PSX.

| ETF Name | 1-Year Return | 3-Year Return (Absolute) | 3-Year CAGR |

| Meezan Pakistan ETF | 31.50% | 174.17% | 39.90% |

| UBL Pakistan Enterprise ETF | 90.81% | 309.93% | 59.70% |

| HBL Total Treasury ETF | 1.35% | n/a | n/a |

Summary: 5-Year Average Returns by Investment Type

| Asset Type | Average Return (5-Year) |

| Money Market Funds | ~13.6% |

| Income Funds | ~13.8% |

| Equity Mutual Funds | ~29.7% |

| KSE‑100 Index (Stocks) | ~28.1% CAGR |

| ETFs (Market-Aligned) | ~40%–60% CAGR |

Final Thoughts on returns

- If capital safety is your priority, Money Market or Income Funds are solid picks.

- For long-term growth, Equity Funds and ETFs offer excellent upside, particularly in bullish markets like FY2024 and FY2025.

- Direct stock investing can deliver high returns—but demands experience, analysis, and emotional control.

Ultimately, your choice depends on your risk appetite, investment horizon, and engagement level. Even a balanced combination of these assets can work wonders.

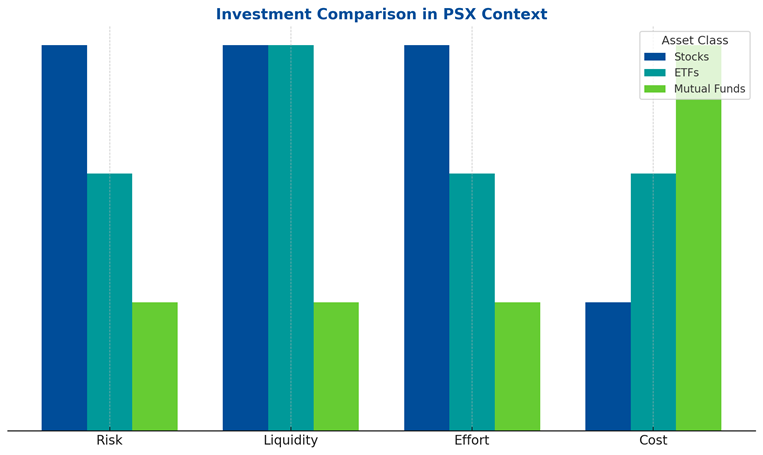

How to Choose: A Straightforward Guide for Pakistani Investors

With so many ways to invest, picking the right option can feel overwhelming. But if you filter your choices through four simple lenses—Risk, Liquidity, Effort, and Cost—the picture becomes much clearer.

1. Risk

Some investments swing more than others.

Stocks tend to carry the highest risk—they can soar or sink quickly.

ETFs spread that risk across many assets, making them more stable.

Mutual Funds are typically the least volatile, as they’re actively managed with risk in mind.

Risk level: Stocks > ETFs > Mutual Funds

2. Liquidity

How fast can you convert your investment back into cash?

Both stocks and ETFs are highly liquid—you can sell them almost instantly during market hours.

Mutual Funds, however, may take a day or more to process redemptions.

Liquidity: Stocks = ETFs > Mutual Funds

3. Effort

How much time and involvement does each option demand?

Stocks require the most hands-on effort—you’ll need to research, monitor markets, and make your own calls.

ETFs offer a middle ground: lower maintenance with built-in diversification.

Mutual Funds are the most passive—just set it and check in occasionally.

Effort: Stocks > ETFs > Mutual Funds

4. Cost

Every option has its price.

Mutual Funds often charge annual fees and management costs that add up.

ETFs are more cost-efficient, though you’ll still pay brokerage fees.

Stocks, while commission-based per trade, can be the cheapest overall if you manage trades smartly.

Cost: Mutual Funds > ETFs > Stocks

So, what’s right for you?

- If you’re a busy professional who wants to invest without much hassle, mutual funds are likely your go-to.

- If you crave control and can stomach the ups and downs, stocks offer the most freedom—and potential reward.

- If your goal is low-cost, hands-off diversification, ETFs might be your perfect middle path.

The Hidden Costs No One Talks About

Mutual Funds

Easy to invest in, but annual management fees, entry/exit loads, and expenses (2%–3%) quietly reduce returns.

Stocks

Fewer direct fees beyond brokerage charges, but require time, research, and effort – an often-overlooked opportunity cost.

ETFs

Low expense ratios and brokerage fees make ETFs efficient, though slight tracking errors may occur.

Taxes

All options are subject to Capital Gains Tax in Pakistan (15%) on short-term gains, with potential relief for long-term holdings.

Summary: Cost Comparison Table

| Instrument | Annual Management Fee | TER / Admin Fees | Transaction Charges | Capital Gains Tax |

| Stocks (PSX) | None | None | 0.15%–0.5% brokerage + Rs.100/month CDC | 15% short-term (FBR Rules) |

| Mutual Funds | 0.9%–1.5% | 2%–3% | Entry/exit loads for some funds | Deducted by AMC, declared to FBR |

| ETFs (PSX) | 0.75% | 1.5% | Brokerage on buy/sell | Same as stocks |

Entry Barriers: Getting Started with Investing

Mutual Funds

Start with as little as PKR 500. Easy to access via apps and ideal for beginners.

Stocks

No fixed minimum—depends on share price. For example, ENGRO trades around PKR 280. Offers flexibility but needs research.

ETFs

Require a brokerage account, with minimum investment typically between PKR 1,000–2,000. Great for instant diversification.

Bottom Line

Investing is now more accessible than ever. Whether you start small or large, the key is to choose what fits your comfort level and begin your journey

No one-size-fits-all solution, but with the right lens, the right choice becomes clear.

Final Thoughts

It’s Not About Timing; It’s About Time in the Market

You don’t need to choose just one option. In fact, a mix of mutual funds, stocks, and ETFs might serve you best. Diversification across types can reduce risk while maximizing opportunity.

Remember, investing is not a sprint. It’s a marathon. Whether you begin with a small mutual fund SIP or a single ETF unit, the key is to start and stay consistent.

Ready to Get Started?

Investment opportunities in Pakistan have never been more accessible. With platforms like MUFAP, PSX, UBL Fund Managers, and HBL Asset Management, you can explore and invest straight from your smartphone.

Not sure where to begin? Start by clarifying your goals, assessing your risk tolerance, and deciding how much capital you’re ready to commit. From there, let this guide help you chart the path toward your investment journey.

No responses yet